Harvester retail sales hit 921 units in July 2025, showing 55.3% growth

Retail harvester sales in July 2025 registered a notable rise of 55.31% compared to July 2024. Let's see brand-wise harvester sales performance in July 2025 and from April to July 2025.

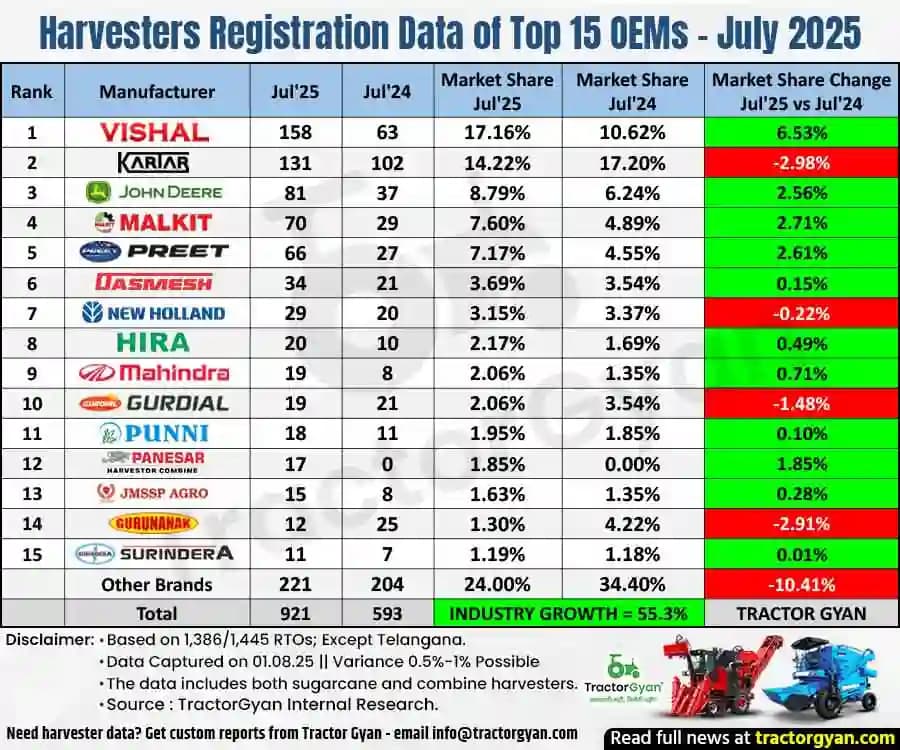

Retail Harvesters Sales in July 2025

In India, 921 harvesters were sold in July 2025, which is 328 more than in July 2024. The overall growth is 55.31%, indicating the increased use of advanced machinery in the fields. While legacy brands continued to dominate the space, competition at the top got tighter.

Vishal Harvesters secured the top position by selling 158 harvester units in July 2025, and its market share increased by 6.53%. Kartar harvester is in 2nd position with sales of 131 units, and its market share also dropped by 2.98% from July 2024.

It was a steady rise for John Deere Harvesters, which sold 81 units and strengthened its standing with an 8.79% market share. The last two brands in the top five were Malkit Harvester and Preet Harvesters. Malkit sold 70 units, which increased its market share by 2.71% while Preet sold 66 units with a market share of 7.17%.

Year-to-Date (April 2025 to July 2025) Harvester Retail Sales

Not only did harvester sales start to rise in July 2025, but they've been going up since the first quarter of FY 2025–26. Between April and July 2025, Indian farmers purchased 4,569 harvesters, compared to 2,954 units during the same period last year. It indicates a substantial rise of 54.67%.

The most popular brand was Kartar Harvesters, which sold 793 units, 52.5% more than its sales of 520 units the previous year. Vishal Harvesters came in second with 690 units, with an increased market share of 0.88%.

Quick Links

Preet and Malkit also did well, selling 422 and 366 units, respectively. Their market shares also increased by 4.53% and 2.22%. Fifth place went to John Deere, known for its high-end design and precise technology. It sold 307 units and has a 6.72% market share in April-July 2025.

| Rank | Manufacturer | Apr'25-Jul'25 | Apr'24-Jul'24 | Market Share Apr'25-Jul'25 |

Market Share Apr'24-Jul'24 |

Market Share Change YTD Jul'24 vs Jul'25 |

|---|---|---|---|---|---|---|

| 1 | Kartar | 793 | 520 | 17.36% | 17.60% | -0.25% |

| 2 | Vishal | 690 | 420 | 15.10% | 14.22% | 0.88% |

| 3 | Preet | 422 | 139 | 9.24% | 4.71% | 4.53% |

| 4 | Malkit | 366 | 171 | 8.01% | 5.79% | 2.22% |

| 5 | John Deere | 307 | 130 | 6.72% | 4.40% | 2.32% |

| 6 | Dasmesh Mechanical | 226 | 109 | 4.95% | 3.69% | 1.26% |

| 7 | New Holland | 122 | 137 | 2.67% | 4.64% | -1.97% |

| 8 | Guru Nanak | 102 | 86 | 2.23% | 2.91% | -0.68% |

| 9 | K.S. Agricultural | 98 | 54 | 2.14% | 1.83% | 0.32% |

| 10 | Mahindra | 88 | 43 | 1.93% | 1.46% | 0.47% |

| 11 | Punni Vishavkarma | 70 | 40 | 1.53% | 1.35% | 0.18% |

| 12 | Panesar Agro | 66 | 18 | 1.44% | 0.61% | 0.84% |

| 13 | Surindera Agro | 64 | 57 | 1.40% | 1.93% | -0.53% |

| 14 | New Gurdial Agro | 61 | 91 | 1.34% | 3.08% | -1.75% |

| 15 | Hira Agro | 60 | 31 | 1.31% | 1.05% | 0.26% |

| Other Brands | 1,034 | 908 | 22.63% | 30.74% | -8.11% | |

| Total | 4,569 | 2,954 | INDUSTRY GROWTH = 54.67% | TRACTOR GYAN | ||

Statewise - Retail Harvesters Sales from April 2025 to July 2025

Here is a more in-depth look at how well each state did in harvesters' sales in July 2025:

Uttar Pradesh was once again the largest buyer, with 1,056 units sold, 23.11% of the country's total harvester sales. Vishal and Kartar were the top-selling harvesters in UP.

Punjab came in second with 960 harvesters. Kartar and Vishal were the top contenders with total sales of 412 units.

Madhya Pradesh is in third position with 524 units, as more farmers in central India switched to advanced machines. MP contribute 11.47% of total harvester sales.

490 harvester units were sold in Haryana, and contribute 10.72% of total sales, and most farmers in the area chose Vishal (150 units) and Kartar (85 units) as their favourites.

In Maharashtra, 379 harvesters were sold, with 8.30% market share.

A Month That Changed the Path of Mechanisation

India's farming is not only getting better but also changing a lot. Farmers are moving beyond trial and hesitation and adopting harvesters faster. Brands like Kartar, Vishal, and Preet are leading the game, while Dasmesh, Malkit, and John Deere are closing the gap with competitive features and pricing.

Why Do Farmers Believe in Tractor Gyan?

At Tractor Gyan, we don't just give you numbers; we also help you understand what they mean for your farming future. We reviewed data and presented it in detail so Indian farmers could better understand the market. Tractor Gyan has everything you need, from the latest information on harvester sales and tractor trends to every detail of farming equipment.

कैटेगरी

और ब्लॉग पढ़ें

Mahindra & Mahindra Ltd., one of India's leading tractor and farm equipment manufacturers, has released its wholesale tractor sales report for July 2025. Let's look at how the brand performed in both domestic and export markets in July 2025.

Mahindra & Mahindra Domestic...

VST Tillers Tractors Limited provides innovative farm machinery for small and mid-sized farms. The company's July 2025 wholesale sales data revealed a 16.74% growth from the same period in 2024.

Wholesale VST Power Tillers Sales in July 2025

Renowned for their efficiency, low fuel...

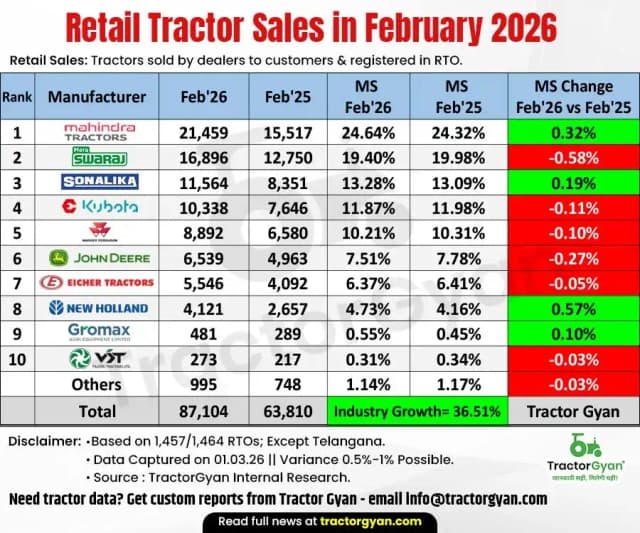

India's retail tractor business kept growing in July 2025. From the same month last year, sales of retail tractors were up by 10.62% because of good Kharif crops, government subsidies, and easy access to loans.

Retail Tractor Sales in July 2025

The retail tractor...

इसके बारे में अपनी टिप्पणी लिखें Harvester retail sales hit 921 units in July 2025, showing 55.3% growth

.webp&w=1920&q=75)

ट्रैक्टर और कृषि से जुड़े सबसे अधिक खोजे जाने वाले ब्लॉग्स

07 Jan 2026

18 Dec 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

09 Feb 2026

31 Jul 2025

18 Dec 2025

26 Dec 2025

.webp&w=2048&q=75)

.webp&w=2048&q=75)

.webp&w=2048&q=75)