Construction Equipment sales in November 2025: Sold 5,579 units, Decline 16.49%

टेबल ऑफ कंटेंट

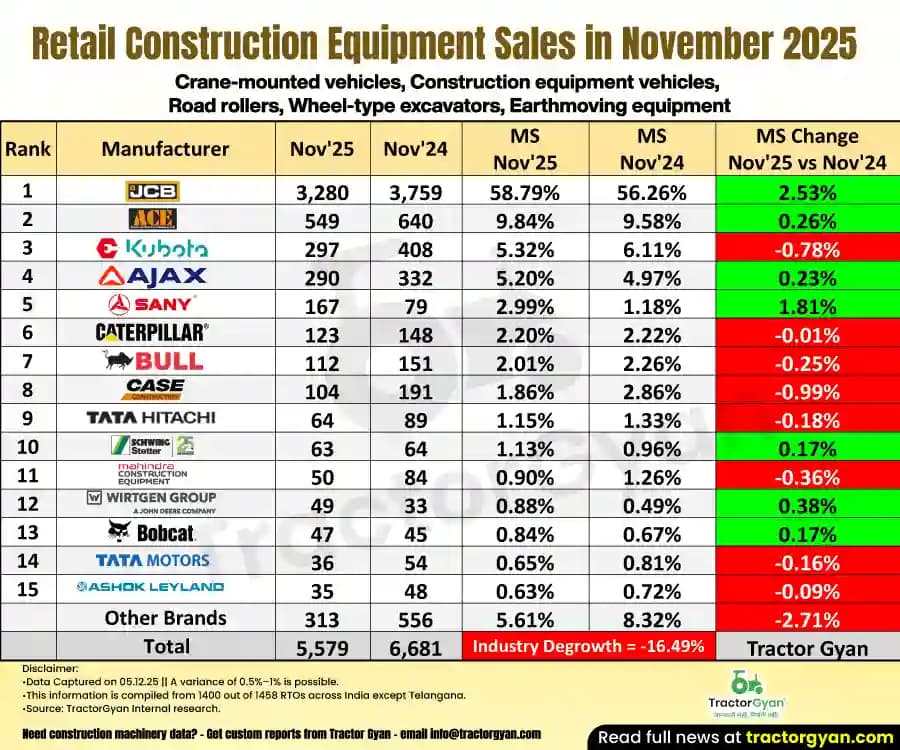

The Indian construction equipment industry recorded 5,579 units in November 2025, compared to 6,681 units in November 2024, showing an industry decline of –16.49%. Let's discuss construction machinery brand-wise YTD and YoY sales.

Construction Equipment Sales in November 2025: Top 5 Brands

In November 2025, JCB continued to dominate the market with 3,280 units, compared to 3,759 units in November 2024. The company’s market share grew from 56.26% to 58.79%, marking a +2.53% improvement, showing how strongly it sustained its leadership despite reduced industry volumes.

ACE secured the second spot with 549 units sold, slightly lower than the 640 units recorded last year; its market share still increased marginally by +0.26%, moving from 9.58% to 9.84%.

In third place, Escorts Kubota registered 297 units, down from 408 units in November 2024. This sharp resulted in a market share drop of –0.78%, reflecting tightening competition in this category.

Ajax, with 290 units sold this month compared to 332 units last year. Despite this, the company showcased steady performance, with its market share increasing from 4.97% to 5.20%, gaining +0.23%.

Rounding off the top five, All Terrain Crane saw sales of 167 units, up from 79 units in November 2024. This remarkable rise boosted its market share by +1.81%, taking it to 2.99% from the previous 1.18%.

Construction Machinery Sales YTD (April 2025 to November 2025): Top 5 Brands

Looking at the year-to-date (YTD) performance from April 2025 to November 2025, the industry recorded an overall degrowth of –11.56%, with total volumes dropping from 49,766 units in YTD 2024 to 44,012 units in YTD 2025.

JCB maintained a commanding lead with 20,927 units, compared to 25,273 units in the same period last year. Its market share also slid by –3.24%, dropping from 50.78% to 47.55%.

In the second position, ACE delivered 4,736 units, down from 5,619 units last year, marking its market share fell by –0.53%, settling at 10.76%.

Ajax, standing third with 2,788 units, recorded a subtle dip compared to 2,923 units in YTD 2024. This –4.62% decline didn’t stop the company from increasing its market share by +0.46%, reaching 6.33%.

Next, Escorts Kubota sold 2,746 units, slightly lower than 3432 units last year. This resulted in a –0.66% market share fall, moving from 6.24% to 6.90%.

Taking the fifth spot, Case New Holland achieved 1,204 units, compared to 1,133 units in YTD 2024. This translates into a +6.27% growth, earning the brand a +0.46% improvement in market share, rising from 2.28% to 2.74%.

| Rank | Manufacturer | Apr'25-Nov'25 | Apr'24-Nov'24 | Market Share Apr'25-Nov'25 |

Market Share Apr'24-Nov'24 |

Market Share Change YTD Nov'25 vs Nov'24 |

|---|---|---|---|---|---|---|

| 1 | JCB | 20,927 | 25,273 | 47.55% | 50.78% | -3.24% |

| 2 | ACE | 4,736 | 5,619 | 10.76% | 11.29% | -0.53% |

| 3 | Ajax | 2,788 | 2,923 | 6.33% | 5.87% | 0.46% |

| 4 | Escorts Kubota | 2,746 | 3,432 | 6.24% | 6.90% | -0.66% |

| 5 | Case New Holland | 1,204 | 1,133 | 2.74% | 2.28% | 0.46% |

| 6 | Caterpillar | 1,078 | 1,370 | 2.45% | 2.75% | -0.30% |

| 7 | Bull Machines | 983 | 841 | 2.23% | 1.69% | 0.54% |

| 8 | All Terrain Crane | 975 | 629 | 2.22% | 1.26% | 0.95% |

| 9 | Tata Hitachi | 871 | 722 | 1.98% | 1.45% | 0.53% |

| 10 | Liugong | 816 | 564 | 1.85% | 1.13% | 0.72% |

| 11 | Mahindra | 755 | 751 | 1.72% | 1.51% | 0.21% |

| 12 | M/S Schwing Stetter | 740 | 677 | 1.68% | 1.36% | 0.32% |

| 13 | Indo Farm | 579 | 504 | 1.32% | 1.01% | 0.30% |

| 14 | Doosan Bobcat | 450 | 378 | 1.02% | 0.76% | 0.26% |

| 15 | Tata Motors | 416 | 457 | 0.95% | 0.92% | 0.03% |

| Other Brands | 3,948 | 4,493 | 8.97% | 9.03% | -0.06% | |

| Total | 44,012 | 49,766 | Industry Degrowth = -11.56% | Tractor Gyan | ||

Quick Links

Conclusion

The construction equipment market in India in November 2025 reflected contrasting trends, with top brands navigating varying levels of growth and decline. While the overall sector experienced noticeable degrowth both monthly (–16.49%) and YTD (–11.56%). As the industry moves toward 2026, manufacturers will need to focus on innovation, efficiency, and demand-driven product strategies to sustain competitiveness in an evolving market.

Tractor Gyan - India's Most Impactful Agri-Tech Voice

Tractor Gyan is India’s most impactful Agri-tech voice, with a thriving community of over 1 million farmers across social media platforms. In the last calendar year alone, we achieved an impressive 56 crore impressions across the internet. Trusted by leading brands like Mahindra, Swaraj, Massey Ferguson, Sonalika, Escorts Kubota, New Holland, Eicher, TVS Credit, Garuda Drones and many more.

कैटेगरी

इसके बारे में अपनी टिप्पणी लिखें Construction Equipment sales in November 2025: Sold 5,579 units, Decline 16.49%

.webp&w=1920&q=75)

ट्रैक्टर और कृषि से जुड़े सबसे अधिक खोजे जाने वाले ब्लॉग्स

07 Jan 2026

18 Dec 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

09 Feb 2026

31 Jul 2025

18 Dec 2025

26 Dec 2025

.webp&w=2048&q=75)

.webp&w=2048&q=75)

.webp&w=2048&q=75)