Retail Harvester Sales in October 2025: Sold 1,591 harvesters, Rise 44.37%

टेबल ऑफ कंटेंट

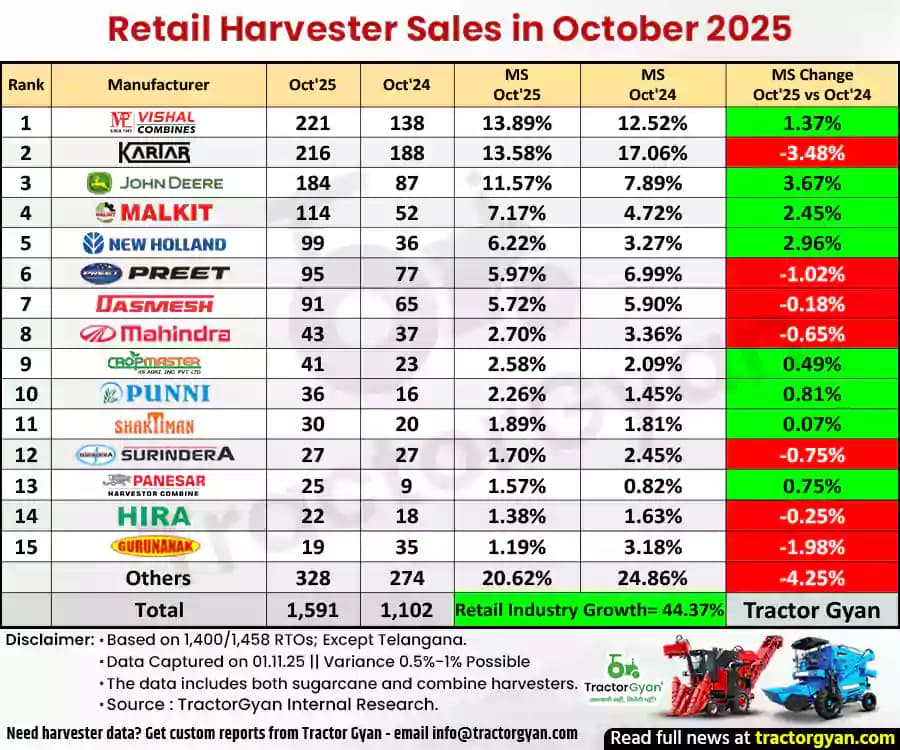

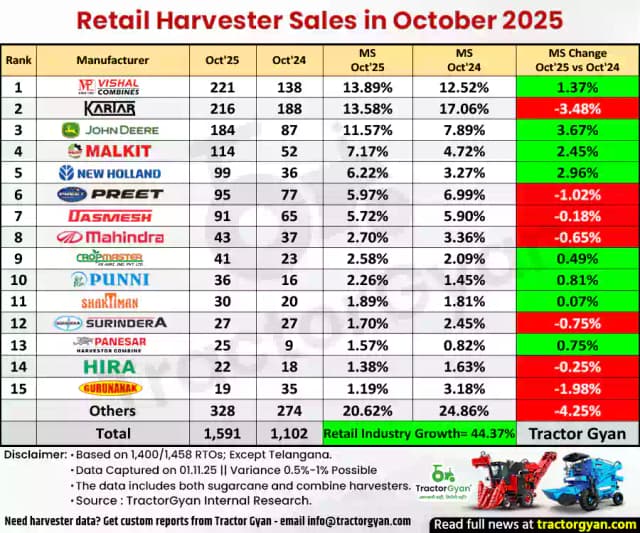

India’s harvester industry witnessed a remarkable jump in October 2025, with retail harvester sales of 1,591 units, compared to 1,102 units in October 2024.

This shows a 44.37% year-on-year growth, reflecting rising mechanisation in farming and increasing demand during the harvesting season.

Retail Harvester Sales in October 2025

Let’s look at how the top 5 brands performed this month compared to last year

- Vishal continued its dominance in the harvester segment with 221 units sold in October 2025, up from 138 units sold in October 2025. This is a strong 60.14% growth, and its market share also increased from 12.52% to 13.89%, making it the top performer of the month.

- Kartar sold 216 units this year against 188 units in October 2024, showing a growth of 14.89% and Its market share dropped from 17.42% to 13.58%.

- John Deere showed phenomenal growth, selling 184 units in October 2025 compared to 87 units last year — a growth of 111.49%. Its market share rose sharply from 7.89% to 11.57% in India’s harvester market.

- Malkit doubled its performance, recording 114 units this October versus 52 units last year, a 119.23% increase. Its market share also improved from 4.72% to 7.17%.

- New Holland sold 99 units this October compared to 36 units last year, indicating a 175% rise. Its market share increased by 2.96%, maintaining its position in the top 5 list.

In October 2025, the top five harvester brands, Vishal, Kartar, John Deere, Malkit, and New Holland, together delivered 830 units out of 1,591 sold nationwide, holding a commanding 52.17% market share.

Retail Harvester Sales YTD (Apr’25 – Oct’25)

Top 5 Brands in Retail Harvester Sales YTD (Apr’25 – Oct’25)

- Vishal maintained its leadership with 1,402 units this year versus 780 units last year — a 79.74% growth. Its market share also jumped from 13.08% to 15.39%, making it the top brand in YTD sales.

- Kartar secured second position with 1,323 units, compared to 965 units last year. While its sales grew by 37.10%, its market share slightly declined from 16.19% to 14.53%.

- Malkit sold 723 units, up from 337 units last year, a 114.54% jump. Its market share rose from 5.65% to 7.94%, reflecting strong demand across states.

- John Deere recorded 709 units this year, compared to 303 units last year, achieving a YoY growth of 133.99% Its market share increased from 5.08% to 7.79%, placing it as a strong challenger among the top brands.

- Preet registered 695 units during April-October 2025, compared to 317 units last year — a 119.24% growth. The brand’s market share improved from 5.32% to 7.63%, keeping it among the top five performers.

Manku, Kartar, Malkit, John Deere, and Preet sold a total of 4,852 harvester units out of 9,107 total harvester sales between April and October 2025. This means they collectively contributed 53.28% of India’s total harvester sales, clearly highlighting their strong dominance in the Indian harvester market.

| Rank | Manufacturer | Apr'25-Oct'25 | Apr'24-Oct'24 | Market Share Apr'25-Oct'25 |

Market Share Apr'24-Oct'24 |

Market Share Change YTD Oct'25 vs Oct'24 |

|---|---|---|---|---|---|---|

| 1 | Vishal | 1,402 | 780 | 15.39% | 13.08% | 2.31% |

| 2 | Kartar | 1,323 | 965 | 14.53% | 16.19% | -1.66% |

| 3 | Malkit | 723 | 337 | 7.94% | 5.65% | 2.29% |

| 4 | John Deere | 709 | 303 | 7.79% | 5.08% | 2.70% |

| 5 | Preet | 695 | 317 | 7.63% | 5.32% | 2.31% |

| 6 | Dasmesh | 533 | 240 | 5.85% | 4.03% | 1.83% |

| 7 | New Holland | 277 | 214 | 3.04% | 3.59% | -0.55% |

| 8 | Punni Vishavkarma | 226 | 154 | 2.48% | 2.58% | -0.10% |

| 9 | Mahindra | 184 | 107 | 2.02% | 1.79% | 0.23% |

| 10 | K.S. Agricultural | 175 | 101 | 1.92% | 1.69% | 0.23% |

| 11 | Guru Nanak | 158 | 147 | 1.73% | 2.47% | -0.73% |

| 12 | Surindera | 132 | 110 | 1.45% | 1.85% | -0.40% |

| 13 | Hira Agro | 126 | 79 | 1.38% | 1.33% | 0.06% |

| 14 | Panesar | 123 | 38 | 1.35% | 0.64% | 0.71% |

| 15 | New Gurdial Agro | 119 | 211 | 1.31% | 3.54% | -2.23% |

| Others | 2,202 | 1,859 | 24.18% | 31.18% | -7.00% | |

| Total | 9,107 | 5,962 | Retail Industry Growth = 52.75% | Tractor Gyan | ||

Quick Links

State-Wise Retail Harvester Sales YTD (Apr’25 – Oct’25)

Retail Harvester Sales Rank-1 Uttar Pradesh Apr’25 to Oct’25

Uttar Pradesh emerged as the largest market with 1,920 units sold, contributing 21.08% to India’s total harvester sales. Vishal led the market here with 335 units (17.45%), followed by Malkit with 215 units (11.20%) and Kartar with 203 units (10.57%).

Retail Harvester Sales Rank-2 Punjab Apr’25 to Oct’25

Punjab stood second with 1,892 units, a strong 20.78% share of the national market. Here, Kartar dominated with 431 units (22.78%), while Vishal with 252 units (13.32%) and Malkit with 119 units (6.29%).

Retail Harvester Sales Rank-3 Madhya Pradesh Apr’25 to Oct’25

Madhya Pradesh ranked third with 1,262 units, contributing 13.86% to total sales. Vishal with 223 units (17.67%), Kartar with 184 units (14.58%), and Preet with 131 units (10.38%) were the top-performing brands in this region.

Retail Harvester Sales Rank-4 Haryana Apr’25 to Oct’25

Haryana contributed 10.64% to total national sales with 969 units. Vishal again led here with 270 units (27.86%), followed by Kartar with 176 units (18.16%) and Preet with 102 units (10.53%).

Retail Harvester Sales Rank-5 Maharashtra Apr’25 to Oct’25

Maharashtra recorded 692 units, accounting for 7.6% of total harvester sales in India. New Holland took the top spot with 148 units (21.31%), followed by Malkit with 98 units (14.16%) and Kartar with 55 units (7.95%).

The top five states contributed 6,735 units out of 9,107 harvesters sold between April and October 2025, accounting for around 73.95% of India’s total retail harvester sales.

Conclusion

The Indian harvester market showed exceptional YoY growth of 44.37% in October 2025 and 52.75% during April–October 2025. With such strong momentum, the harvester industry is on track to set new records in the upcoming Rabi season.

Tractor Gyan – India's Most Impactful Agri-Tech Voice

Tractor Gyan is India’s most impactful Agri-tech voice, with a thriving community of over 1 million farmers across social media platforms. In the last calendar year alone, we achieved an impressive 56 crore impressions across the internet. Trusted by leading brands like Mahindra, Swaraj, Massey Ferguson, Sonalika, Escorts Kubota, New Holland, Eicher, TVS Credit, Garuda Drones and many more.

कैटेगरी

और ब्लॉग पढ़ें

November 01, 2025, Mumbai: Mahindra & Mahindra’s Farm Equipment Business (FEB), a leading player in India’s tractor industry, reported an impressive performance in October 2025. Mahindra & Mahindra tractor sales in October 2025 recorded 73,660 units with 13% growth compared to 65,453 tractor units...

India’s tractor industry continued its steady momentum in October 2025, recording total retail tractor sales of 71,976 units, marking a healthy growth of 13.68% compared to 63,314 units in October 2024. This steady rise highlights the growing confidence of farmers and the...

Sonalika Tractors has once again proven its dominance in the Indian tractor market by achieving record-breaking sales of 27,028 units in October 2025. This phenomenal performance reflects the company’s strong brand value, innovative technology, and trust among farmers across India.

Sonalika recorded the...

इसके बारे में अपनी टिप्पणी लिखें Retail Harvester Sales in October 2025: Sold 1,591 harvesters, Rise 44.37%

.webp&w=1920&q=75)

ट्रैक्टर और कृषि से जुड़े सबसे अधिक खोजे जाने वाले ब्लॉग्स

30 Jul 2025

30 Jul 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

29 Sep 2025

31 Jul 2025

30 Jul 2025

31 Jul 2025

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)