Retail Tractor Market Grew by 8.26% in June 2025, With 76,271 Units Sold Across India

Retail tractor sales in June 2025 have been quite an eventful for India's tractor industry. While most of the country geared up for the monsoon, the rural economy saw an uptick in demand for agricultural equipment, especially tractors.

With sowing activity kicking off in several regions, farmers seemed optimistic. And that's reflected in the numbers. Retail tractor sales across the country reportedly performed better compared to June last year, with an 8.26% hike, showing signs of improving crop cycles and easier credit options.

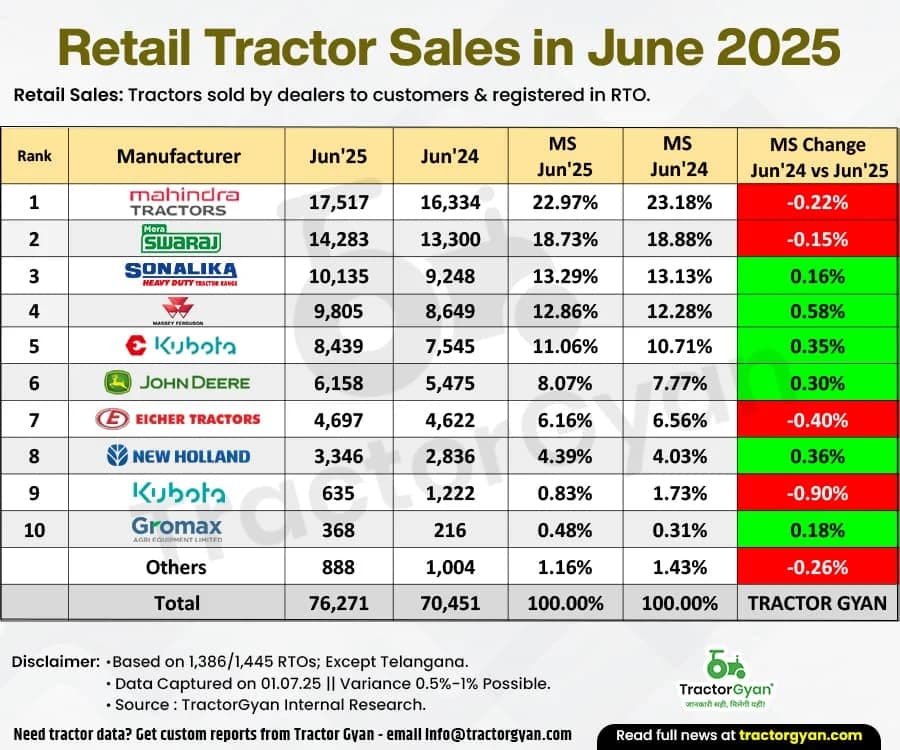

Retail Tractor Sales in June 2025 vs June 2024: Strong Growth Across Leading Brands

Overall, retail tractor sales touched around 76,271 units, which is up from last year's 70,451 units. One key factor here was the early arrival of monsoons in some parts and better post-Rabi liquidity in the rural belt.

Mahindra & Mahindra once again topped the chart with 17,517 units sold. It managed to improve its sales by around 7.24%, holding its ground as a trusted name among Indian farmers.

Swaraj Tractors continued to perform well with 14,283 units in sales. Though the retail tractor of Swaraj increased by 7.39% the company’s market share dropped 0.15%. Sonalika Tractors came third by selling 10,135 units and showing modest growth in market share by 0.16%.

Massey Ferguson held the fourth position, selling 9,805 tractors. The brand saw a 0.58% growth in market share compared to last year. Escorts Kubota occupied the fifth spot with 8,439 units, which is a rise of about 11.84% from June 2024's sales of 7,545 units.

Year-to-Date Retail Tractor Sales: April-June 2025 vs. April-June 2024

Zooming out a bit, the April-to-June quarter gave us a clearer picture of how the financial year has begun. The total retail sales in these three months reached around 2,06,459 units, showing a 5.67% increase from the same period last year, which is a solid sign of consistency.

Mahindra & Mahindra is still leading the way, selling 48,083 units in Q1 of FY25, which is about 7.06% more than last year. Swaraj Tractors followed with 39,536 units, marking an improvement of 5.60% over April–June 2024.

Sonalika Tractors sold 27,541 units, growing from 25,892 units last year in the same quarter. Massey Ferguson is right behind with 24,152 units, which translates to a market share increase of around 0.04%. Escorts Kubota sold 22,971 units, showing a 9% rise compared to Q1 of the previous year.

| Rank | Manufacturer | Apr'25-Jun'25 | Apr'24-Jun'24 | MS Q1 Apr'25-Jun'25 | MS Q1 Apr'24-Jun'24 | MS Change Q1 FY'25 vs FY'26 |

|---|---|---|---|---|---|---|

| 1 | Mahindra | 48,083 | 44,912 | 23.29% | 22.99% | 0.30% |

| 2 | Swaraj | 39,536 | 37,438 | 19.15% | 19.16% | -0.01% |

| 3 | Sonalika | 27,541 | 25,892 | 13.34% | 13.25% | 0.09% |

| 4 | Massey Ferguson | 24,152 | 22,783 | 11.70% | 11.66% | 0.04% |

| 5 | Escorts Kubota | 22,971 | 21,073 | 11.13% | 10.79% | 0.34% |

| 6 | John Deere | 16,904 | 15,278 | 8.19% | 7.82% | 0.37% |

| 7 | Eicher | 12,675 | 12,968 | 6.14% | 6.64% | -0.50% |

| 8 | New Holland | 8,901 | 8,062 | 4.31% | 4.13% | 0.18% |

| 9 | Kubota | 2,210 | 3,456 | 1.07% | 1.77% | -0.70% |

| 10 | Gromax | 814 | 537 | 0.39% | 0.27% | 0.12% |

| Others | 2,672 | 2,972 | 1.29% | 1.52% | -0.23% | |

| Total | 2,06,459 | 1,95,371 | 100.00% | 100.00% | Tractor Gyan |

Regional Leaders: State-Wise Retail Tractor Sales Performance YTD June 2025

Let's take a look at which states made the highest contribution to retail tractor sales in June 2025.

Uttar Pradesh, as always, led the charge with 33,283 units sold. That's about 16.12% of the total national sales. Rajasthan came second with 29,423 units, making up 14.25% of total sales. Madhya Pradesh followed with 25,469 units, which is about 12.34% of the national share. Government subsidy schemes and water availability played a key role in this growth.

Maharashtra recorded 24,332 units, contributing 11.79%. Karnataka stood fifth with 14,672 units sold, making up 7.11% of the market. So overall, it was the northern and western belts that powered the tractor market this month.

Conclusion

FY 2025-26 is off to a decent start for tractor manufacturers. While we aren't seeing a massive boom, there's a clear indication that farmer sentiment is positive, especially in states with better rainfall and irrigation support.

Brands are also scaling their presence, offering more features, flexible financing, and even digital tools to attract buyers. With monsoons progressing well and sowing activity picking up pace, the upcoming months could see a further bump in numbers.

Role of Tractor Gyan

At Tractor Gyan, we do more than just report sales; we dive deep into what's driving them. From tracking trends and decoding rural demand to highlighting regional shifts, we provide reliable, data-backed insights for farmers, dealers, and tractor brands.

Our updates help businesses make smarter decisions while also giving farmers the tools and information they need to choose what's best for their land.

कैटेगरी

और ब्लॉग पढ़ें

Indian farmers trust the name Mahindra & Mahindra when it comes to tractors and other agricultural equipment. The Mahindra and Mahindra Tractor Sales in June 2025 show more than just numbers. They show how people trust innovative machines and how their preferences have changed...

Escorts Kubota tractor sales in June 2025 & Q1 show a good performance in the tractor market. The brand is doing well and changing how it does things to stay ahead in a competitive industry, as shown by the number of wholesale tractors...

VST Tillers Tractors Limited makes useful and innovative farming machines for small and medium-sized farms. The VST Tillers Tractors Sales in June 2025 show that the brand is growing and staying strong despite the tough market.

Wholesale VST Power Tillers Sales in June 2025

VST's...

इसके बारे में अपनी टिप्पणी लिखें Retail Tractor Market Grew by 8.26% in June 2025, With 76,271 Units Sold Across India

.webp&w=1920&q=75)

ट्रैक्टर और कृषि से जुड़े सबसे अधिक खोजे जाने वाले ब्लॉग्स

18 Dec 2025

18 Dec 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

29 Sep 2025

31 Jul 2025

18 Dec 2025

31 Jul 2025

.webp&w=2048&q=75)

.webp&w=2048&q=75)

.webp&w=2048&q=75)