Construction Equipment sales in October 2025: Sold 5,769 units, Decline 30.47%

टेबल ऑफ कंटेंट

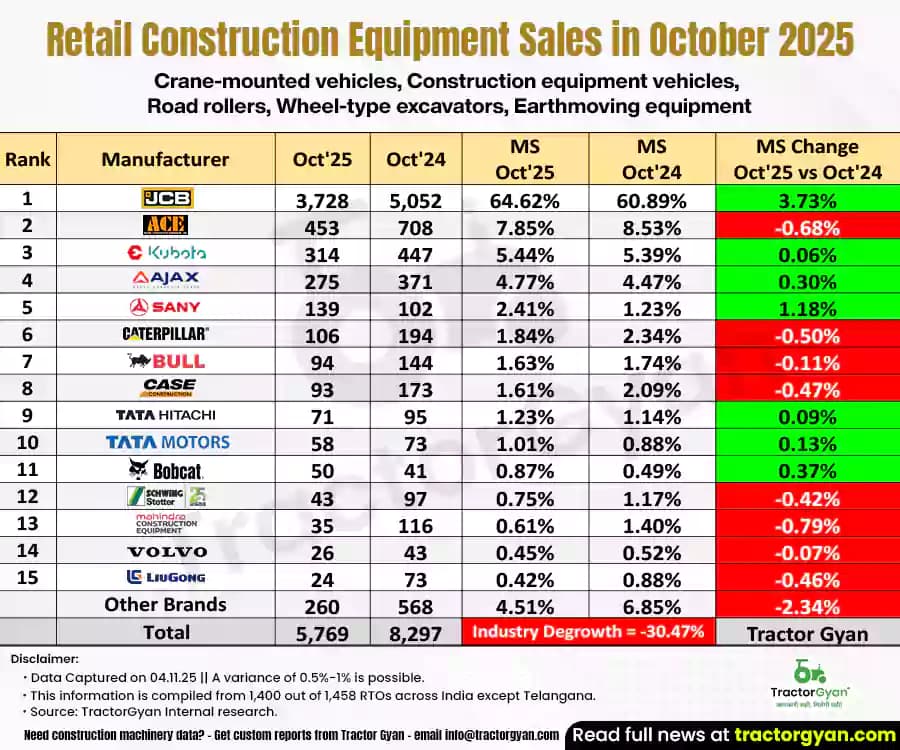

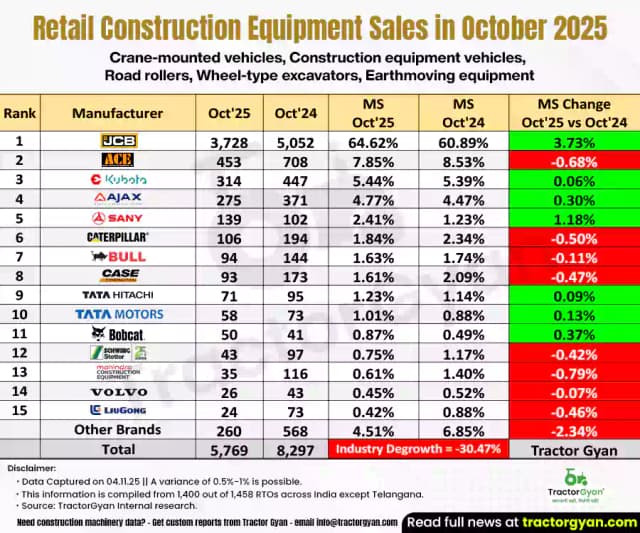

India’s construction equipment industry experienced a slowdown in October 2025, as total retail sales fell to 5,769 units, down from 8,296 units in October 2024, a 30.47% year-on-year (YoY) decline. Let’s take a closer look at how the sector performed in October 2025, along with its YTD and YoY comparisons in detail.

Construction Equipment Sales in October 2025

- JCB maintained its dominance in the Indian construction equipment market with 3,728 units sold in October 2025, compared to 5,052 units in October 2024. Despite a sales decline of 26.21%, JCB’s market share rose to 64.62%, marking a 3.73% increase YoY. This reflects JCB’s strong brand presence.

- ACE recorded 453 units sold in October 2025, down from 708 units last year, indicating a drop of 36.02% YoY. Its market share fell slightly from 8.53% to 7.85%, showing a 0.68% decrease.

- Escorts Kubota achieved 314 unit sales in October 2025 compared to 447 units in October 2024, showing a 29.75% YoY decline. However, the Escorts Kubota’s market share slightly increased to 5.44%, up 0.06%.

- AJAX sold 275 units in October 2025, down from 371 units last year, witnessing a 25.88% drop. Its market share improved marginally by 0.30%, reaching 4.77%, owing to its strong performance in the concrete equipment segment.

- All Terrain Crane with 139 units sold in October 2025 versus 102 units in October 2024, All Terrain Crane saw a 36.27% YoY rise. Its market share improved to 2.41%, up 1.18%.

Overall, the top five players together sold around 4,909 units out of the total 5,769 units in October 2025, contributing more than 85.09% of the total industry sales, which reaffirms their strong market dominance despite an overall industry degrowth of 30.47%.

Construction Machinery Sales YTD (April 2025 to October 2025)

- JCB sold 17,588 units between April and October 2025, compared to 21,514 units during the same period in 2024 — reflecting a sales decline of 18.25% YoY. Its market share dropped by 4.17%, from 49.94% to 45.76%, though JCB continues to be the undisputed leader in the Indian market.

- ACE sold 4,185 units from April to October 2025, against 4,979 units last year, marking a 15.95% fall in sales. Its market share decreased by 0.67%, from 11.56% to 10.89%.

- AJAX maintained steady performance with 2,496 units sold from April to October 2025, compared to 2,591 units during same period last year, showing a 3.67% decline. Interestingly, its market share increased by 0.48%, reaching 6.49%.

- From April to October 2025, Escorts Kubota sold 2,447 units, down from 3,024 units last year, translating to a 19.08% drop. Its market share declined slightly by 0.65%, reaching 6.37%.

- CASE New Holland registered 1,100 unit sales between April–October 2025, compared to 942 units in the same period of 2024, achieving a 16.77% growth — one of the few brands to show positive momentum. Its market share rose by 0.68%, reaching 2.86%, showing strong customer confidence in heavy equipment.

These top five players collectively sold around 27,816 units out of the total 38,433 units between April and October 2025, accounting for over 72.38% of total YTD sales. This reflects their continued dominance in India’s construction machinery market despite an overall industry-wide degrowth of 10.79%.

| Rank | Manufacturer | Apr'25-Oct'25 | Apr'24-Oct'24 | Market Share Apr'25-Oct'25 |

Market Share Apr'24-Oct'24 |

Market Share Change YTD Oct'25 vs Oct'24 |

|---|---|---|---|---|---|---|

| 1 | JCB | 17,588 | 21,514 | 45.76% | 49.94% | -4.17% |

| 2 | ACE | 4,185 | 4,979 | 10.89% | 11.56% | -0.67% |

| 3 | Ajax | 2,496 | 2,591 | 6.49% | 6.01% | 0.48% |

| 4 | Escorts Kubota | 2,447 | 3,024 | 6.37% | 7.02% | -0.65% |

| 5 | Case New Holland | 1,100 | 942 | 2.86% | 2.19% | 0.68% |

| 6 | Caterpillar | 951 | 1,222 | 2.47% | 2.84% | -0.36% |

| 7 | Bull Machines | 871 | 690 | 2.27% | 1.60% | 0.66% |

| 8 | All Terrain Crane | 856 | 586 | 2.23% | 1.36% | 0.87% |

| 9 | Tata Hitachi | 804 | 631 | 2.09% | 1.46% | 0.63% |

| 10 | Liugong | 782 | 490 | 2.03% | 1.14% | 0.90% |

| 11 | Mahindra | 704 | 667 | 1.83% | 1.55% | 0.28% |

| 12 | M/S Schwing | 677 | 613 | 1.76% | 1.42% | 0.34% |

| 13 | Indo Farm | 554 | 444 | 1.44% | 1.03% | 0.41% |

| 14 | Doosan Bobcat | 403 | 333 | 1.05% | 0.77% | 0.28% |

| 15 | Tata Motors | 377 | 403 | 0.98% | 0.94% | 0.05% |

| Other Brands | 3,638 | 3,953 | 9.47% | 9.18% | 0.29% | |

| Total | 38,433 | 43,082 | Industry Degrowth = -10.79% | Tractor Gyan | ||

Quick Links

Conclusion

The Indian construction equipment sector faced a challenging October 2025, with both monthly (-30.47%) and YTD (-10.79%) sales declining compared to last year. While most brands saw negative growth due to weak market sentiment and delayed infrastructure spending.

In the coming months, as infrastructure projects gain momentum, overall market performance is expected to improve with steady demand and better growth opportunities.

Tractor Gyan - India's Most Impactful Agri-Tech Voice

Tractor Gyan is India’s most impactful Agri-tech voice, with a thriving community of over 1 million farmers across social media platforms. In the last calendar year alone, we achieved an impressive 56 crore impressions across the internet. Trusted by leading brands like Mahindra, Swaraj, Massey Ferguson, Sonalika, Escorts Kubota, New Holland, Eicher, TVS Credit, Garuda Drones and many more.

कैटेगरी

और ब्लॉग पढ़ें

India’s tractor industry continued its steady momentum in October 2025, recording total retail tractor sales of 71,976 units, marking a healthy growth of 13.68% compared to 63,314 units in October 2024. This steady rise highlights the growing confidence of farmers and the...

Sonalika Tractors has once again proven its dominance in the Indian tractor market by achieving record-breaking sales of 27,028 units in October 2025. This phenomenal performance reflects the company’s strong brand value, innovative technology, and trust among farmers across India.

Sonalika recorded the...

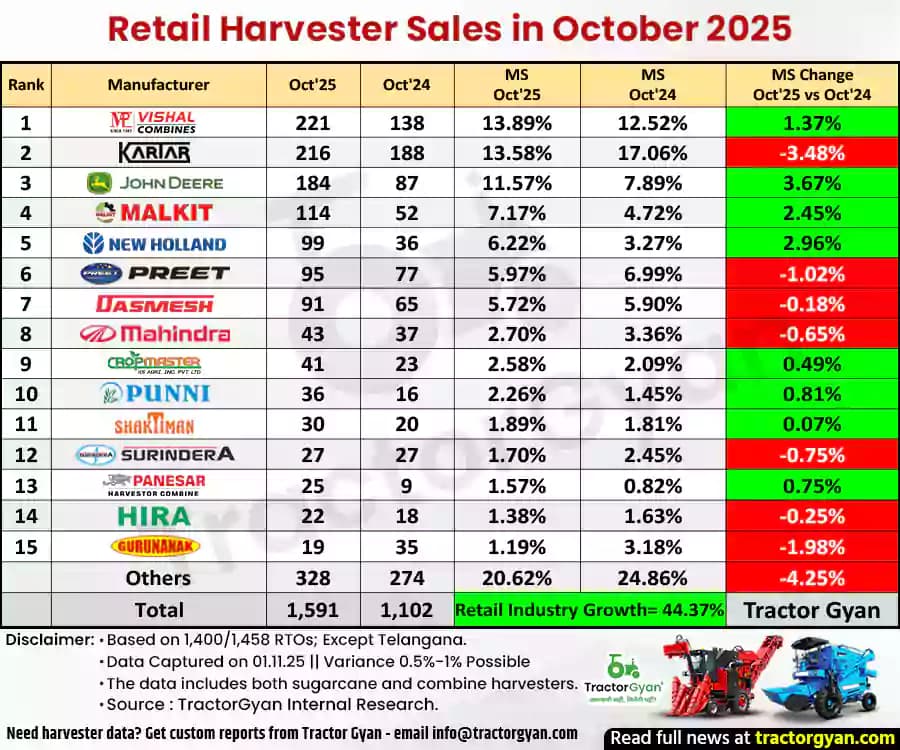

India’s harvester industry witnessed a remarkable jump in October 2025, with retail harvester sales of 1,591 units, compared to 1,102 units in October 2024.

This shows a 44.37% year-on-year growth, reflecting rising mechanisation in farming and increasing demand during the harvesting season.

इसके बारे में अपनी टिप्पणी लिखें Construction Equipment sales in October 2025: Sold 5,769 units, Decline 30.47%

.webp&w=1920&q=75)

ट्रैक्टर और कृषि से जुड़े सबसे अधिक खोजे जाने वाले ब्लॉग्स

30 Jul 2025

30 Jul 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

29 Sep 2025

31 Jul 2025

30 Jul 2025

31 Jul 2025

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)