Retail tractor sales in Calendar Year 2025: Sold 9,78,748 tractors, Rise 10.92%

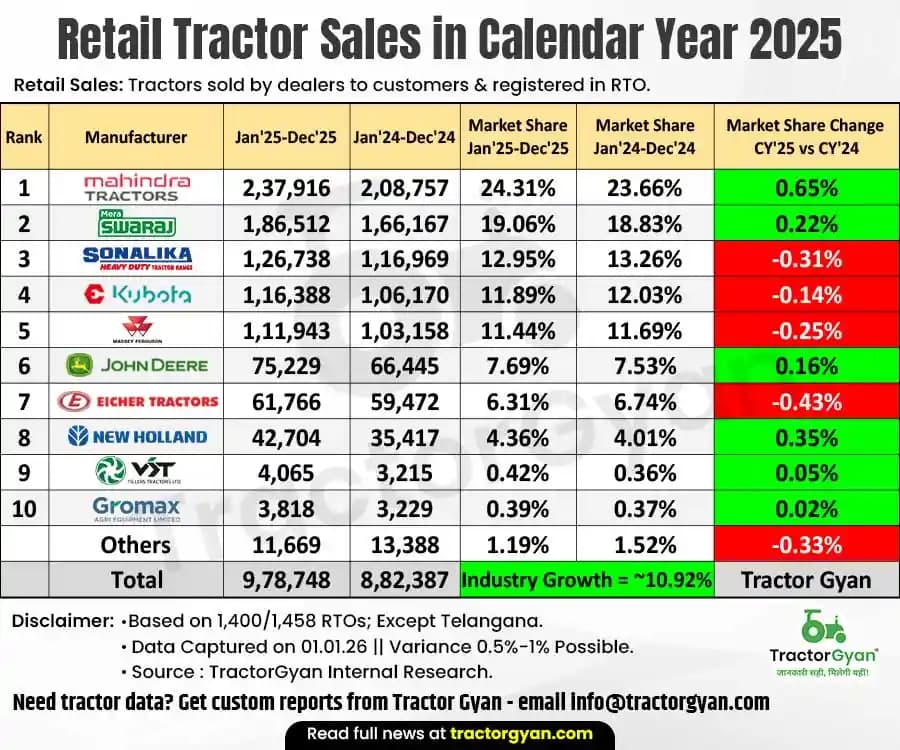

India’s tractor industry delivered a strong performance in Calendar Year 2025, with total retail sales reaching 9,78,748 units, compared to 8,82,387 units in CY 2024. This marks a 10.92% year-on-year growth, bringing the industry very close to the historic 10 lakh tractor sales milestone.

The growth was driven by multiple factors such as GST reduction on tractors, strong government focus on the agriculture sector, higher manufacturer push, and steady non-agricultural demand from construction and haulage segments. Controlled dealer inventory levels also supported healthier retail numbers through the year.

Retail Tractor Sales in Calendar Year 2025

Mahindra continued to dominate the Indian tractor market in CY 2025 with retail sales of 2,37,916 units, compared to 2,08,757 units in CY 2024. Its market share improved from 23.66% to 24.31%, clearly strengthening its leadership position.

Swaraj recorded retail sales of 1,86,512 units in CY 2025, up from 1,66,167 units last year, while its market share edged up from 18.83% to 19.06%, indicating stable demand.

Sonalika sold 1,26,738 tractors in CY 2025 against 1,16,969 units in CY 2024. Its market share slipped slightly from 13.26% to 12.95%.

Escorts Kubota reported retail sales of 1,16,388 units in CY 2025, compared to 1,06,170 units last year. Market share declined marginally from 12.03% to 11.89%.

Massey Ferguson achieved retail sales of 1,11,943 units in CY 2025, up from 1,03,158 units in CY 2024. This represents a slight market share decrease from 11.69% to 11.44%.

The top five tractor brands sold 7,79,497 units in CY 2025, contributing around 79.64% of total retail tractor sales of 9,78,748 units.

| Rank | Manufacturer | Jan'25-Dec'25 | Jan'24-Dec'24 | Market Share Jan'25-Dec'25 |

Market Share Jan'24-Dec'24 |

Market Share Change CY'25 vs CY'24 |

|---|---|---|---|---|---|---|

| 1 | Mahindra | 2,37,916 | 2,08,757 | 24.31% | 23.66% | 0.65% |

| 2 | Swaraj | 1,86,512 | 1,66,167 | 19.06% | 18.83% | 0.22% |

| 3 | Sonalika | 1,26,738 | 1,16,969 | 12.95% | 13.26% | -0.31% |

| 4 | Escorts Kubota | 1,16,388 | 1,06,170 | 11.89% | 12.03% | -0.14% |

| 5 | Massey Ferguson | 1,11,943 | 1,03,158 | 11.44% | 11.69% | -0.25% |

| 6 | John Deere | 75,229 | 66,445 | 7.69% | 7.53% | 0.16% |

| 7 | Eicher | 61,766 | 59,472 | 6.31% | 6.74% | -0.43% |

| 8 | New Holland | 42,704 | 35,417 | 4.36% | 4.01% | 0.35% |

| 9 | VST | 4,065 | 3,215 | 0.42% | 0.36% | 0.05% |

| 10 | Gromax (Trakstar) | 3,818 | 3,229 | 0.39% | 0.37% | 0.02% |

| Others | 11,669 | 13,388 | 1.19% | 1.52% | -0.33% | |

| Total | 9,78,748 | 8,82,387 | Industry Growth = ~10.92% | Tractor Gyan | ||

Group-wise Retail Tractor Sales in Calendar Year 2025

The Mahindra Group (Mahindra + Swaraj + Gromaxx) remained the largest tractor group in CY 2025 with combined sales of 4,28,246 units, compared to 3,78,153 units in CY 2024. The group record rise in market share from 42.86% to 43.75%.

The TAFE Group (Massey Ferguson + Eicher) sold 1,73,709 units in CY 2025, up from 1,62,630 units in CY 2024. Its market share declined from 18.43% to 17.75%.

The Sonalika Group (Sonalika + Solis) reported retail sales of 1,26,738 units in CY 2025 versus 1,16,969 units in the previous year. Despite growth in sales numbers, market share dropped slightly from 13.26% to 12.95%.

The Escorts Kubota Group (Farmtrac + Powrtrac + Kubota + Adico) recorded sales of 1,16,388 units in CY 2025, compared to 1,06,170 units in CY 2024, but market share dipped marginally from 12.03% to 11.89%.

John Deere sold 75,229 tractors in CY 2025 against 66,445 units last year, and market share improved from 7.53% to 7.69%, indicating steady brand traction.

The top five tractor groups recorded 9,20,310 units in CY 2025, accounting for about 94.3% of the total industry sales of 9,78,748 units.

State-wise Retail Tractor Sales in Calendar Year 2025

Maharashtra emerged as the largest tractor market in CY 2025 with retail sales of 1,46,584 units, contributing 14.98% of total national sales. Strong agricultural activity and non-agri demand supported its leadership.

Uttar Pradesh followed closely with 1,37,609 units, accounting for around 14.06% of total retail tractor sales. Consistent demand from small and marginal farmers continued to drive volumes.

Rajasthan recorded retail sales of 1,22,037 units in CY 2025, contributing approximately 12.47%. The state remained a key tractor market due to extensive farming and haulage usage.

Madhya Pradesh sold 1,17,099 tractors, capturing about 11.96% share. Rising mechanisation and government support programs aided steady demand growth.

Gujarat rounded off the top five with 85,214 units, contributing 8.71% of total sales. The state continued to benefit from diversified agriculture and strong rural infrastructure.

The top five states together sold 6,08,543 tractors in CY 2025, contributing nearly 62.18% of the total retail tractor sales of 9,78,748 units.

Retail Tractor Sales Outlook for 2026

In Calendar Year 2026, tractor demand may face short-term pressure due to the implementation of TREM V emission norms for tractors below 50 HP. If these norms are enforced without any extension, purchase decisions could be delayed due to higher costs.

However, if the government extends the deadline, the industry has the potential to reach an all-time high of around 10.5 lakh tractor sales. The gradual introduction of electric and CNG tractors is also expected to open new opportunities, particularly in non-agricultural segments such as construction and haulage.

Conclusion

Calendar Year 2025 was a strong year for the Indian tractor industry, with retail sales growing 10.92% year-on-year to 9,78,748 units. Growth was supported by the government's focus on agriculture, GST reduction, strong manufacturer push, and steady non-agricultural demand.

Despite regulatory challenges ahead, the long-term outlook for the tractor industry remains positive, supported by policy backing, innovation, and expanding usage beyond agriculture.

Tractor Gyan – India's Most Impactful Agri-Tech Voice

India’s most impactful Agri-tech voice, with a thriving community of over 1 million farmers across social media platforms. In the last calendar year alone, we achieved an impressive 56 crore impressions across the internet. Trusted by leading brands like Massey Ferguson, Sonalika, Eicher, Mahindra Finance, Farmtrac and many more.

कैटेगरी

और ब्लॉग पढ़ें

1st January 2025, Mumbai: Mahindra & Swaraj sold a total of 31,859 tractors in December 2025, significantly higher than 22,943 units in December 2024, reflecting a solid year-on-year growth with 39%. Let’s discuss the Mahindra & Mahindra tractor sales for December...

01st January 2025, Mumbai: VST tiller tractor sales are 4,376 units in December 2025, while in December 2024, the company had sold 3,372 units. This indicates a healthy year-on-year growth of around 29.77%, reflecting improving demand in the farm mechanisation segment. Let’s discuss...

India’s retail tractor sales witnessed strong momentum in December 2025. The total retail tractor sales are 1,13,265 units in December 2025, compared to 98,344 units in December 2024. This reflects a healthy year-on-year growth of 15.17%. Let’s discuss the December 2025 and...

इसके बारे में अपनी टिप्पणी लिखें Retail tractor sales in Calendar Year 2025: Sold 9,78,748 tractors, Rise 10.92%

.webp&w=1920&q=75)

ट्रैक्टर और कृषि से जुड़े सबसे अधिक खोजे जाने वाले ब्लॉग्स

18 Dec 2025

18 Dec 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

26 Dec 2025

31 Jul 2025

18 Dec 2025

26 Dec 2025

.webp&w=2048&q=75)

.webp&w=2048&q=75)

.webp&w=2048&q=75)