Above 50 HP vs below 50 HP - Retail tractor sales in July 2025

Table of Content

Above 50 HP tractors are becoming increasingly common in commercial farming and heavy-duty work, while small and medium-sized farms still prefer tractors under 50 HP. This month, the Above 50 HP and Below 50 HP retail tractor sales data illustrate which brands performed best in each category, market shares, and competitive position.

Above 50 HP (Trem IV) - Retail Tractor Sales in July 2025

In the highly competitive above 50 HP (TREM IV) market, John Deere led the market in July 2025, selling 540 units, capturing 36.54% of the segment. Mahindra followed closely in second spot, selling 468 units, accounting for 31.66% market share.

In third place was Swaraj, which sold 149 units and contributed around 10.08% to the segment's sales. These three brands accounted for 78.28% of the total above 50 HP retail tractor sales of 1478 units.

Below 50 HP - Retail Tractor Sales in July 2025

The Below 50 HP category continued to be dominated by Mahindra, which sold 20,135 units in July 2025, representing a 23.33% market share. Swaraj came in second, with 16,575 units sold, capturing about 19.20% of the market.

Sonalika stood third by selling 12,427 units, with 14.40% of the market share. Together, these three brands accounted for around 56.93% of the total below 50 HP retail tractor sales volume of 86,310 units.

Quick Links

Retail Tractor Sales Above 50 HP - April to July 2025

When looking at the period from April to July 2025, John Deere led the Above 50 HP segment with 2,063 units and 36.17% market share. Mahindra remained in second place with 1,856 units and 32.54% market share.

Swaraj held the third position with 588 units sold and a market share of 10.31%. These three brands comprised approximately 78.52% of the cumulative retail tractor sales of above 50 HP, totalling 5,704 units across the quarter.

Retail Tractor Sales Below 50 HP - April to July 2025

During this quarter, Mahindra sold 66,851 vehicles in the Below 50 HP segment with a market share of 23.17%. Swaraj came in next with the sale of 55,685 units and 19.30% market share, and Sonalika sold 39,698 units with a market share of 13.76%.

Overall, these three best-sellers contributed to a large extent, accounting for almost 56.22% of 2,88,543 units being sold below 50 HP in retail tractor sales.

| Rank | Manufacturer | Above 50HP (Trem IV) |

Market Share Above 50HP |

Below 50HP |

Market Share Below 50HP |

|---|---|---|---|---|---|

| 1 | John Deere | 2,063 | 36.17% | 21,793 | 7.55% |

| 2 | Mahindra | 1,856 | 32.54% | 66,851 | 23.17% |

| 3 | Swaraj | 588 | 10.31% | 55,685 | 19.30% |

| 4 | New Holland | 472 | 8.27% | 12,279 | 4.26% |

| 5 | Sonalika | 394 | 6.91% | 39,698 | 13.76% |

| 6 | Escorts Kubota | 131 | 2.30% | 32,043 | 11.11% |

| 7 | Massey Ferguson | 88 | 1.54% | 33,729 | 11.69% |

| 8 | Eicher | 39 | 0.68% | 18,808 | 6.52% |

| 9 | Same Deutz Fahr | 29 | 0.51% | 176 | 0.06% |

| 10 | Preet | 14 | 0.25% | 570 | 0.20% |

| Other Brands | 30 | 0.53% | 6,911 | 2.40% | |

| Total | 5,704 | TRACTOR GYAN | 2,88,543 | TRACTOR GYAN |

Conclusion

In July 2025, John Deere became the market leader in the above-50 HP tractor segment due to its good performance and after-sales service. In the below-50 HP segment, Mahindra still rides the rural and small-farmer wave with its fuel-efficient tractor models.

Sonalika, Swaraj, Massey Ferguson, and Escorts Kubota remained major players, performing well in various power segments and geographies.

Tractor Gyan - India’s Most Trusted AgriTech Platform

India’s most impactful AgriTech voice, with a thriving community of over 1 million farmers across social media platforms. In the last calendar year alone, we achieved an impressive 56 crore impressions across the internet. Trusted by leading brands like Massey Ferguson, Sonalika, Eicher, Mahindra Finance, Farmtrac and many more.

Category

Read More Blogs

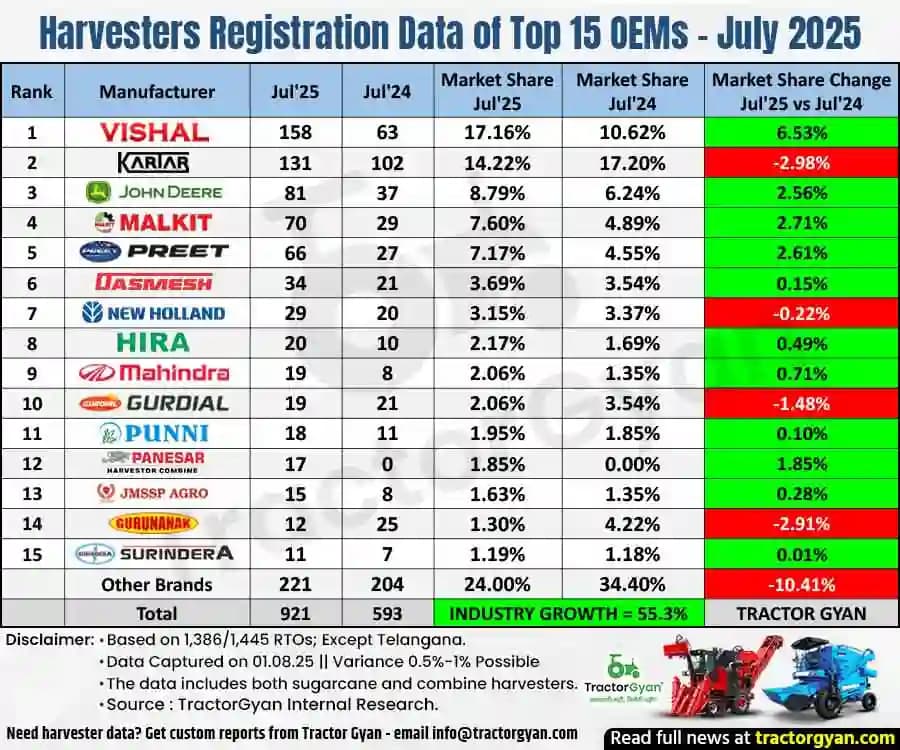

Retail harvester sales in July 2025 registered a notable rise of 55.31% compared to July 2024. Let's see brand-wise harvester sales performance in July 2025 and from April to July 2025.

Retail Harvesters Sales in July 2025

In India, 921 harvesters were sold in...

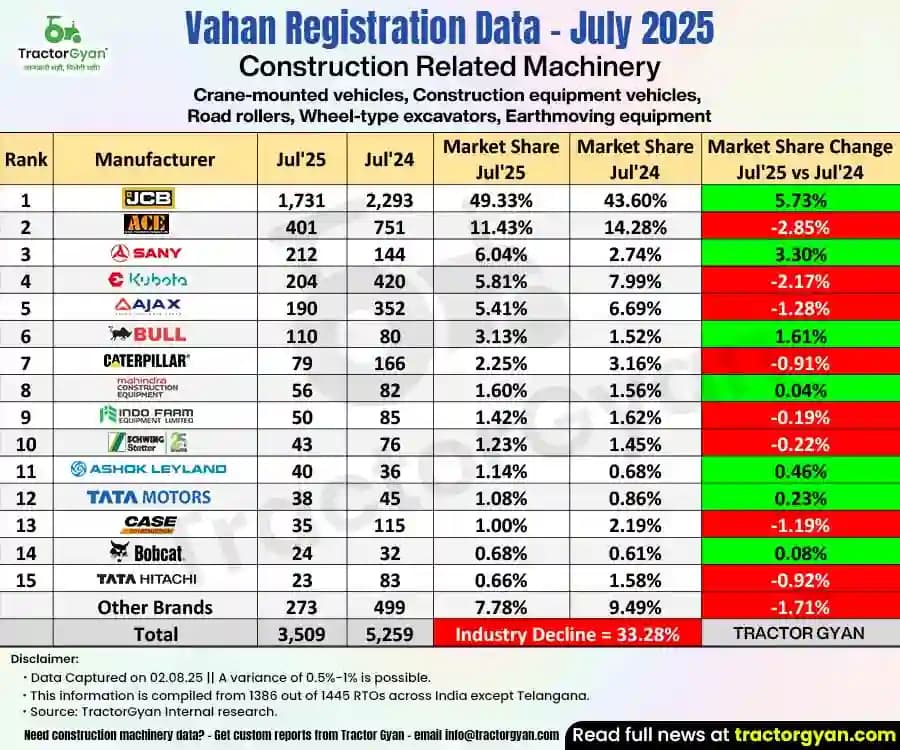

India's infrastructure game is in full swing. There is a thriving market for construction equipment behind all that dust and work. Despite this, the sales for construction machinery in July 2025 dropped by 33.28%. Look at the July 2025 construction machinery sales...

Retail Industry Sales in July 2025

Want to know more about the numbers in the image above? Click below to read more 👇

Write Your Comment About Above 50 HP vs below 50 HP - Retail tractor sales in July 2025

.webp&w=1920&q=75)

Top searching blogs about Tractors and Agriculture

07 Jan 2026

18 Dec 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

09 Feb 2026

31 Jul 2025

18 Dec 2025

26 Dec 2025

.webp&w=2048&q=75)

.webp&w=2048&q=75)

.webp&w=2048&q=75)