Construction Equipment sales in December 2025: Sold 5,824 units, Decline 18.5%

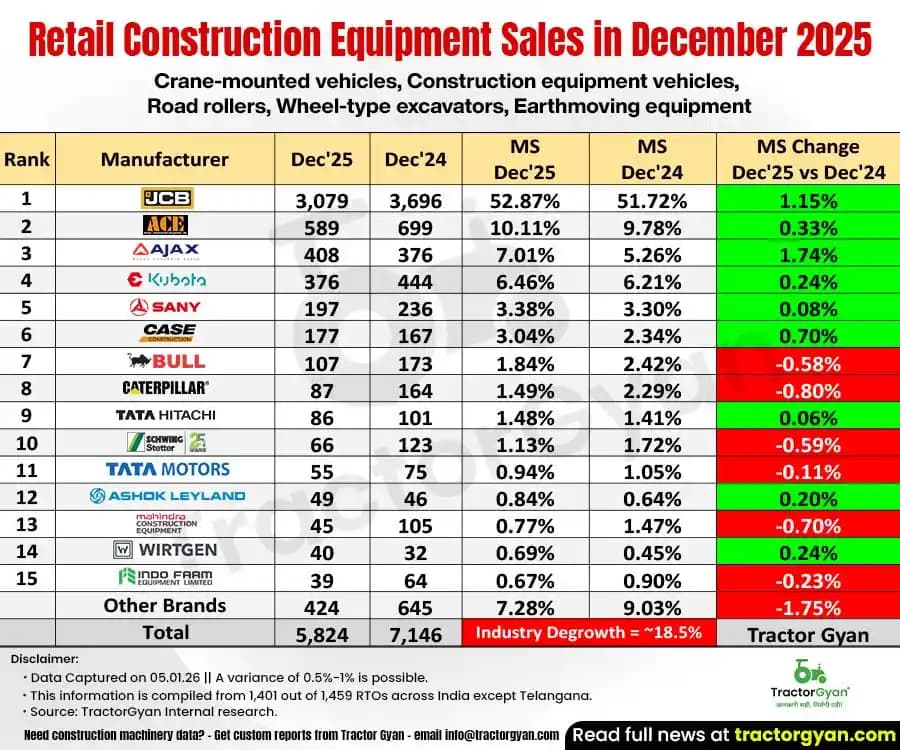

India’s construction equipment industry witnessed a slowdown in December 2025. Total retail sales stood at 5,824 units, compared with 7,146 units in December 2024, reflecting an industry degrowth of around 18.5% YoY. Let’s discuss the December 2025 and YTD (Apr to Dec 2025) performance of the top brands in detail.

Construction Equipment Sales in December 2025

- JCB remained the clear market leader in December 2025, selling 3,079 units compared to 3,696 units in December 2024, marking a YoY decline of around 16.69%. Despite lower volumes, JCB’s market share improved to 52.87%, up from 51.72% last year, reflecting its strong dominance in a shrinking market.

- ACE recorded 589 units in December 2025, down from 699 units in December 2024, resulting in a YoY decline of approximately 15.74%. The company held a market share of 10.11%, marginally higher than 9.78% in the same month last year.

- Ajax stood out among the top five by posting 408 units in December 2025, compared to 376 units a year earlier. This translates into a YoY growth of about 8.51%, with market share rising sharply to 7.01% from 5.26%, indicating strong traction amid industry conditions.

- Escorts Kubota sold 376 units in December 2025 versus 444 units in December 2024, registering a YoY decline of nearly 15.32%. Its market share edged up slightly to 6.46%, compared to 6.21% last year, supported by better relative performance than the industry average.

- All Terrain Crane reported sales of 197 units in December 2025, down from 236 units in December 2024, reflecting a YoY decline of around 16.53%. The brand maintained a market share of 3.38%, marginally higher than 3.30% in the previous year.

In December 2025, the top five construction equipment brands together sold 4,649 units, out of the industry total of 5,824 units. This means the leading five players accounted for around 79.82% of total construction equipment sales during the month, clearly highlighting the highly concentrated nature of the market, even amid an overall industry degrowth of 18.5% YoY.

Construction Machinery Sales YTD (April 2025 to December 2025)

- JCB led the market with 24,041 units sold during April–December 2025, down from 28,970 units in the previous year, reflecting a YoY decline of nearly 17.01%. JCB accounted for a dominant 48.24% market share, although this was lower than 50.89% recorded last year.

- ACE registered 5,330 units in the YTD period, compared to 6,319 units a year ago, resulting in a YoY decline of about 15.65%. The company’s market share stood at 10.70%, slightly lower than 11.10% in April–December 2024.

- Ajax sold 3,202 units during April–December 2025, marginally lower than 3,300 units last year, translating into a YoY decline of around 2.97%. However, its market share improved to 6.43%, up from 5.80%, indicating relative outperformance.

- Escorts Kubota recorded 3,127 units, down from 3,876 units in the same period last year, marking a YoY decline of nearly 19.32%. The brand’s market share declined to 6.27%, compared to 6.81% in the previous year.

- CASE New Holland delivered 1,383 units during April–December 2025, up from 1,300 units last year. This represents a YoY growth of approximately 6.38%, with market share improving to 2.78% from 2.28%.

| Rank | Manufacturer | Apr'25-Dec'25 | Apr'24-Dec'24 | Market Share Apr'25-Dec'25 |

Market Share Apr'24-Dec'24 |

Market Share Change |

|---|---|---|---|---|---|---|

| 1 | JCB | 24,041 | 28,970 | 48.24% | 50.89% | -2.65% |

| 2 | ACE | 5,330 | 6,319 | 10.70% | 11.10% | -0.40% |

| 3 | Ajax | 3,202 | 3,300 | 6.43% | 5.80% | 0.63% |

| 4 | Escorts Kubota | 3,127 | 3,876 | 6.27% | 6.81% | -0.53% |

| 5 | Case New Holland | 1,383 | 1,300 | 2.78% | 2.28% | 0.49% |

| 6 | Caterpillar | 1,166 | 1,534 | 2.34% | 2.69% | -0.35% |

| 7 | Bull Machines | 1,091 | 1,014 | 2.19% | 1.78% | 0.41% |

| 8 | All Terrain Crane | 1,083 | 830 | 2.17% | 1.46% | 0.72% |

| 9 | Tata Hitachi | 959 | 823 | 1.92% | 1.45% | 0.48% |

| 10 | Liugong | 855 | 635 | 1.72% | 1.12% | 0.60% |

| 11 | M/s Schwing Stetter | 807 | 801 | 1.62% | 1.41% | 0.21% |

| 12 | Mahindra | 800 | 857 | 1.61% | 1.51% | 0.10% |

| 13 | Indo Farm | 619 | 571 | 1.24% | 1.00% | 0.24% |

| 14 | Doosan Bobcat | 486 | 420 | 0.98% | 0.74% | 0.24% |

| 15 | Tata Motors | 473 | 532 | 0.95% | 0.93% | 0.01% |

| Other Brands | 4,414 | 5,146 | 8.86% | 9.04% | -0.18% | |

| Total | 49,836 | 56,928 | Industry Degrowth = ~12.46% | Tractor Gyan | ||

During April–December 2025, the top five construction machinery brands collectively recorded 37,083 units, out of the total industry sales of 49,836 units. This translates into a contribution of approximately 74.41% of total YTD sales, reaffirming that a handful of dominant manufacturers continue to drive nearly three-fourths of the Indian construction machinery market despite a 12.46% industry degrowth.

Quick Links

Conclusion

December 2025 proved challenging for India’s construction equipment industry, with the top five brands collectively contributing a majority of total sales, yet most of them witnessed double-digit YoY declines in monthly volumes. On a YTD basis (April–December 2025), the market remained under pressure, showing a 12.46% industry degrowth.

Overall, the data highlights a consolidated market led by a few dominant brands, where maintaining market share has become as critical as driving volume growth amid slowing demand.

Tractor Gyan - India's Most Impactful Agri-Tech Voice

Tractor Gyan is India’s most impactful Agri-tech voice, with a thriving community of over 1 million farmers across social media platforms. In the last calendar year alone, we achieved an impressive 56 crore impressions across the internet. Trusted by leading brands like Mahindra, Swaraj, Massey Ferguson, Sonalika, Escorts Kubota, New Holland, Eicher, TVS Credit, Garuda Drones and many more.

Category

Read More Blogs

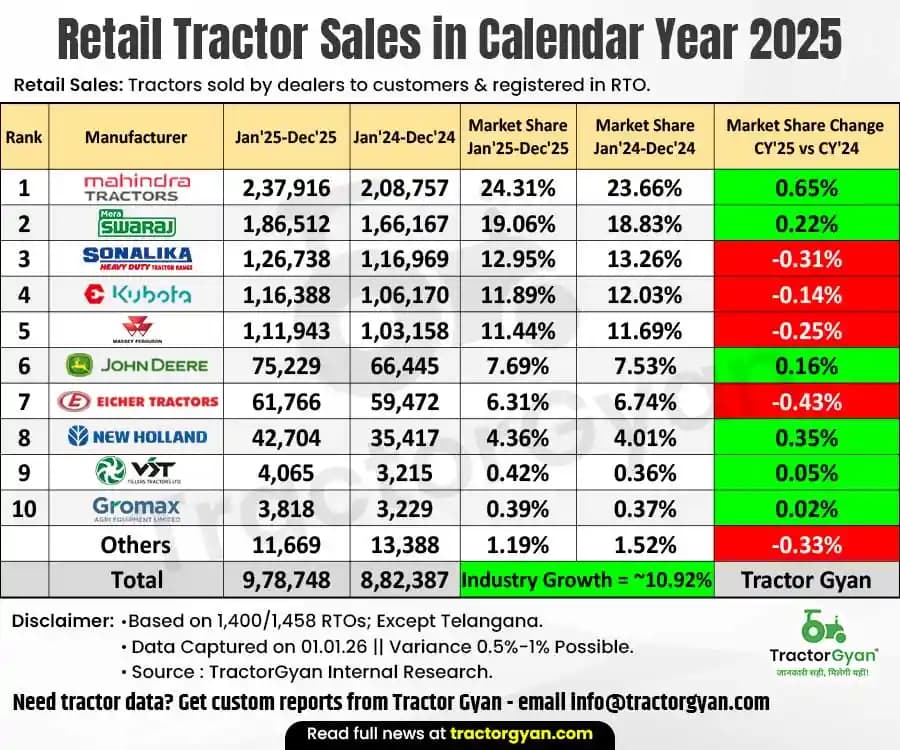

India’s tractor industry delivered a strong performance in Calendar Year 2025, with total retail sales reaching 9,78,748 units, compared to 8,82,387 units in CY 2024. This marks a 10.92% year-on-year growth, bringing the industry very close to the historic 10 lakh tractor...

In December 2025, Sonalika tractors achieved overall sales of 12,392 tractors, marking a new peak in the company’s growth journey. This achievement underlines the brand’s growing trust among farmers across domestic and global markets.

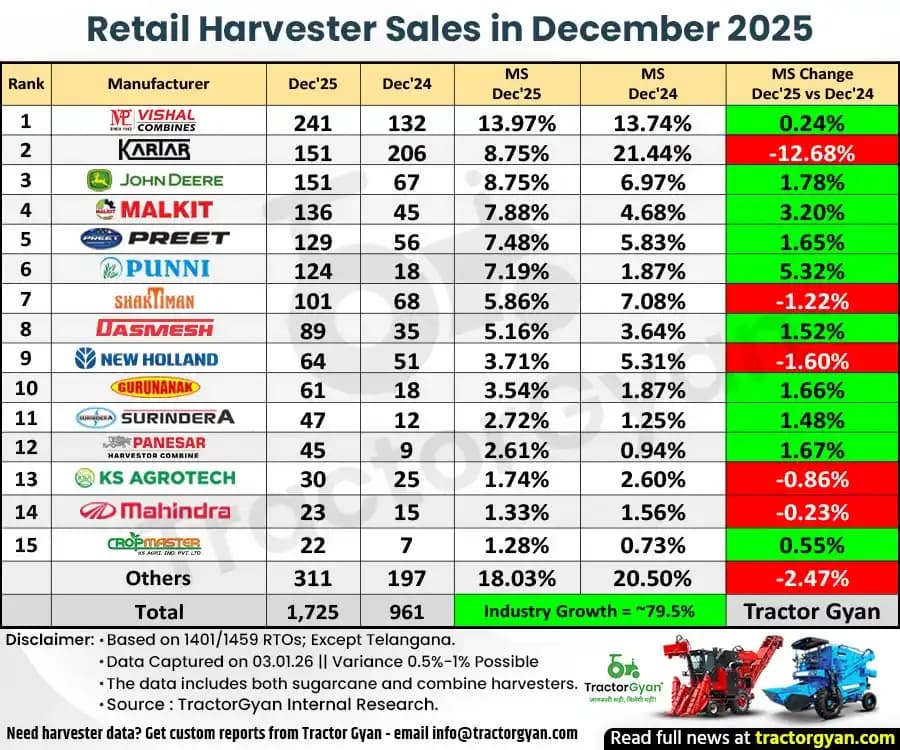

Retail harvester sales are 1,725 units in December 2025, significantly higher than 961 units in December 2024, registering a sharp growth of around 79.5% year-on-year. This momentum was not limited to a single month, as cumulative sales during April 2025 to December...

Write Your Comment About Construction Equipment sales in December 2025: Sold 5,824 units, Decline 18.5%

.webp&w=1920&q=75)

Top searching blogs about Tractors and Agriculture

07 Jan 2026

18 Dec 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

09 Feb 2026

31 Jul 2025

18 Dec 2025

26 Dec 2025

.webp&w=2048&q=75)

.webp&w=2048&q=75)

.webp&w=2048&q=75)