Retail Harvester Sales in December 2025: Sold 1,725 harvesters, Rise 79.5%

Retail harvester sales are 1,725 units in December 2025, significantly higher than 961 units in December 2024, registering a sharp growth of around 79.5% year-on-year. This momentum was not limited to a single month, as cumulative sales during April 2025 to December 2025 (YTD) also showed robust expansion, highlighting sustained demand in the harvesting equipment segment. Let’s take a detailed look at brand-wise December 2025 and YTD sales and state-wise performance.

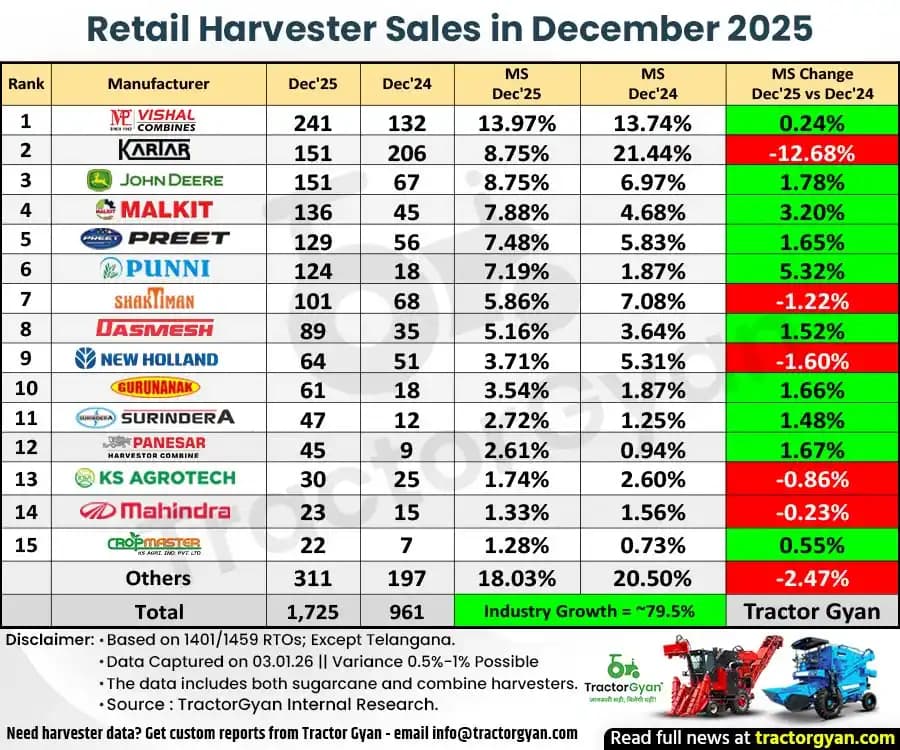

Retail Harvesters Sales in December 2025

Vishal emerged as the market leader in December 2025 with retail sales of 241 harvesters, up from 132 units in December 2024. This translated into a market share that improved marginally from 13.74% to 13.97%, indicating stable leadership.

Kartar reported retail sales of 151 units in December 2025, compared to 206 units in December 2024. This marked a decline in market share from 21.44% to 8.75%.

John Deere recorded strong growth, with December 2025 sales reaching 151 units, up from 67 units in December 2024. This resulted in a growth of market share from 6.97% to 8.75%, highlighting improved brand traction.

Malkit sold 136 harvesters in December 2025, compared to 45 units in December 2024, and its market share rose sharply from 4.68% to 7.88%, indicating rapid expansion.

Preet posted December 2025 sales of 129 units, up from 56 units in December 2024. This translated into the rise of market share from 5.83% to 7.48%.

The top five harvester brands together sold 808 units in December 2025. Out of the total 1,725 units sold during the month, these brands accounted for approximately 46.84% of total retail harvester sales, underlining a moderately consolidated market structure.

Retail Harvesters Sales YTD (April 2025 to December 2025)

Vishal maintained its leadership position on a YTD basis, selling 1,943 harvesters during April–December 2025, compared to 1,066 units in the same period last year. This reflected a growth in market share from 13.55% to 15.53%.

Kartar reported YTD sales of 1,619 units, up from 1,330 units last year. Despite volume growth, its market share declined from 16.91% to 12.94%.

John Deere saw YTD sales rise to 1,004 units, compared to 444 units in the previous year, with market share improving from 5.64% to 8.02%, signalling strong long-term momentum.

Malkit recorded 965 units in YTD sales, up from 458 units last year. This represented a market share increase from 5.82% to 7.71%.

Preet achieved YTD sales of 949 units, compared to 426 units in the previous year. This marked market share rose from 5.42% to 7.58%.

The top five brands together sold 6,480 harvesters during April–December 2025. Out of the total 12,513 units sold in the period, these brands contributed around 51.79% of total retail harvester sales, indicating that more than half of the market demand came from these leading manufacturers.

| Rank | Manufacturer | Apr'25-Dec'25 | Apr'24-Dec'24 | Market Share Apr'25-Dec'25 |

Market Share Apr'24-Dec'24 |

Market Share Change YTD Dec'25 vs Dec'24 |

|---|---|---|---|---|---|---|

| 1 | Vishal | 1,943 | 1,066 | 15.53% | 13.55% | 1.98% |

| 2 | Kartar | 1,619 | 1,330 | 12.94% | 16.91% | -3.97% |

| 3 | John Deere | 1,004 | 444 | 8.02% | 5.64% | 2.38% |

| 4 | Malkit | 965 | 458 | 7.71% | 5.82% | 1.89% |

| 5 | Preet | 949 | 426 | 7.58% | 5.42% | 2.17% |

| 6 | Dasmesh | 705 | 323 | 5.63% | 4.11% | 1.53% |

| 7 | New Holland | 544 | 374 | 4.35% | 4.75% | -0.41% |

| 8 | Punni Vishavkarma | 375 | 181 | 3.00% | 2.30% | 0.70% |

| 9 | Guru Nanak | 263 | 187 | 2.10% | 2.38% | -0.28% |

| 10 | Shaktiman | 248 | 202 | 1.98% | 2.57% | -0.59% |

| 11 | Mahindra | 241 | 135 | 1.93% | 1.72% | 0.21% |

| 12 | K.S. Agricultural | 233 | 125 | 1.86% | 1.59% | 0.27% |

| 13 | Panesar | 206 | 51 | 1.65% | 0.65% | 1.00% |

| 14 | Surindera | 191 | 142 | 1.53% | 1.81% | -0.28% |

| 15 | Hira | 156 | 87 | 1.25% | 1.11% | 0.14% |

| Others | 2,871 | 2,335 | 22.94% | 29.68% | -6.74% | |

| Total | 12,513 | 7,866 | Industry Growth = ~59.08% | Tractor Gyan | ||

Statewise – Retail Harvesters Sales from April 2025 to December 2025

Rank 1 - Uttar Pradesh: Retail Harvester Sales from April 2025 to December 2025

Uttar Pradesh ranked first with retail sales of 2,472 harvesters, contributing 19.76% to total YTD sales. The state continued to be the largest market, driven by extensive agricultural activity.

Rank 2 - Punjab: Retail Harvester Sales from April 2025 to December 2025

Punjab secured the second position with 2,181 units, accounting for 17.43% of total sales. Strong mechanisation levels supported consistent demand in the state.

Rank 3 - Madhya Pradesh: Retail Harvester Sales from April 2025 to December 2025

Madhya Pradesh stood third with 1,655 harvesters sales, contributing 13.23% to national sales, reflecting the growing adoption of harvesting equipment.

Rank 4 - Maharashtra: Retail Harvester Sales from April 2025 to December 2025

Maharashtra recorded 1,502 units during the period, accounting for 12.00% of total sales, supported by diversified crop patterns.

Rank 5 - Haryana: Retail Harvester Sales from April 2025 to December 2025

Haryana ranked fifth with 1,185 harvesters, contributing 9.47% to overall retail sales.

The top five states together recorded retail sales of 8,995 harvesters during April 2025 to December 2025. Out of the total 12,513 units sold across India in this period, these five states contributed approximately 71.89% of the total retail harvester sales. This clearly indicates that more than two-thirds of the country’s harvester demand was concentrated in a few key agricultural states, underlining their critical role in driving overall market growth.

Conclusion

Retail harvester sales in India showed robust growth in both December 2025 and YTD April–December 2025, supported by strong demand from key brands and agriculturally dominant states. While the top manufacturers continued to strengthen their positions, the data also highlights shifts in market share, indicating increasing competition and evolving farmer preferences across regions.

Tractor Gyan – India's Most Impactful Agri-Tech Voice

India’s most impactful Agri-tech voice, with a thriving community of over 1 million farmers across social media platforms. In the last calendar year alone, we achieved an impressive 56 crore impressions across the internet. Trusted by leading brands like Massey Ferguson, Sonalika, Eicher, Mahindra Finance, Farmtrac and many more.

Category

Read More Blogs

India’s retail tractor sales witnessed strong momentum in December 2025. The total retail tractor sales are 1,13,265 units in December 2025, compared to 98,344 units in December 2024. This reflects a healthy year-on-year growth of 15.17%. Let’s discuss the December 2025 and...

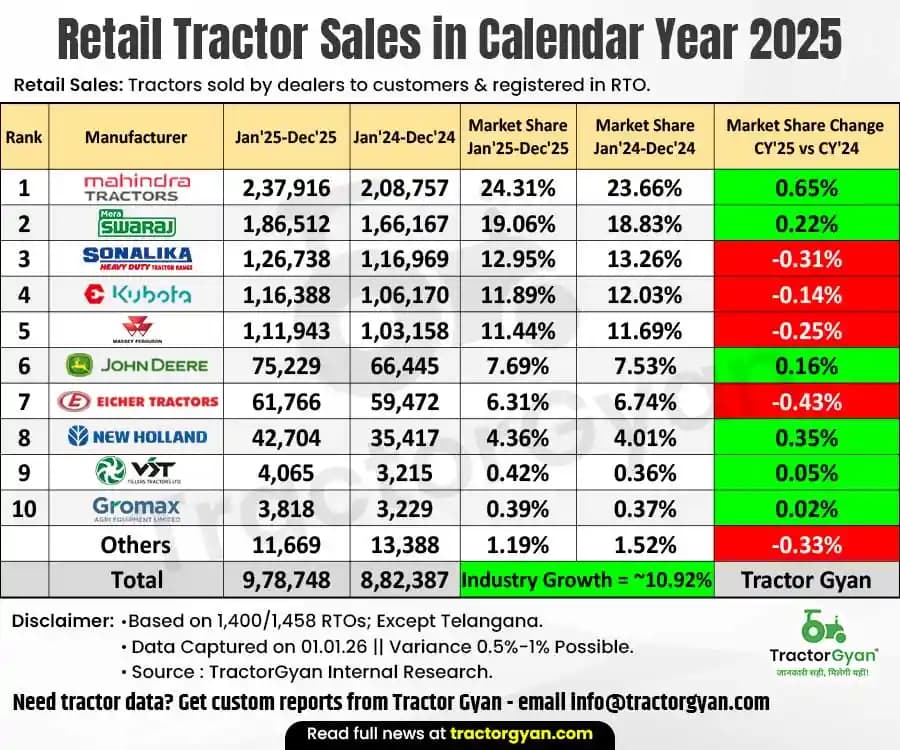

India’s tractor industry delivered a strong performance in Calendar Year 2025, with total retail sales reaching 9,78,748 units, compared to 8,82,387 units in CY 2024. This marks a 10.92% year-on-year growth, bringing the industry very close to the historic 10 lakh tractor...

In December 2025, Sonalika tractors achieved overall sales of 12,392 tractors, marking a new peak in the company’s growth journey. This achievement underlines the brand’s growing trust among farmers across domestic and global markets.

Write Your Comment About Retail Harvester Sales in December 2025: Sold 1,725 harvesters, Rise 79.5%

.webp&w=1920&q=75)

Top searching blogs about Tractors and Agriculture

07 Jan 2026

18 Dec 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

09 Feb 2026

31 Jul 2025

18 Dec 2025

26 Dec 2025

.webp&w=2048&q=75)

.webp&w=2048&q=75)

.webp&w=2048&q=75)