Retail Harvester Market Registered 51.55% Growth in May 2025, Sold 1,364 Harvesters

Growing mechanization, optimal crop conditions, and acceptance of modern agri-tech solutions are supporting the Indian harvester market's strong upward momentum in May 2025.

Harvester sales have increased 51.55% year-over-year as farmers use more efficient harvesting machines to boost yield and reduce labour. This article examines May 2025 retail harvester sales, including year-to-date performance, top brands, and regional sales patterns.

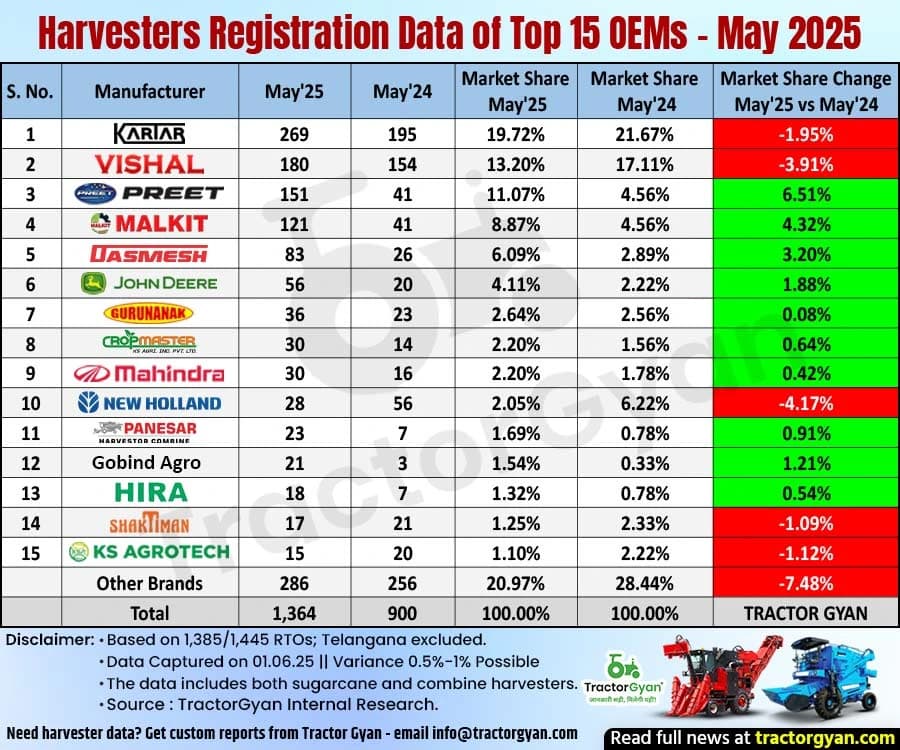

May 2025 vs May 2024: A Stable Growth Path for Brands

In May 2025, the Indian harvester market grew 51.55% from May 2024 by selling a total of 1,364 units. This increase shows farmers' increasing dependence on mechanical solutions.

Selling 269 units, Kartar Harvesters once more took first place in May 2025. However, its market share decreased by 1.95% and its sales increased by 74 compared to May 2024, implying increasing competition from other newly developing companies. With 180 units sold in May 2025, Vishal Harvesters ranked second, considering the whole market, and has maintained its performance at 13.20% of the market share.

Selling 151 units in May 2025, Preet Harvesters maintained its upward trend and landed in third position with a market share of 11.07%. Malkit Harvesters is in the 4th position with an market share of 8.87% in May 2025. Dasmesh Harvesters, with sales of 83 units, showed a remarkable increase, therefore adding 6.09% to the total market share.

Year-to-Date (April 2025 - May 2025 vs. April 2024 - May 2024) Harvester Sales

|

Harvester Retail Sales FY 2025-2026 |

||||||

|---|---|---|---|---|---|---|

|

S.No. |

Manufacturer |

Apr'25-May'25 |

Apr'24-May'24 |

Market Share |

Market Share |

MS Change |

|

1 |

Kartar |

505 |

303 |

18.62% |

17.17% |

1.45% |

|

2 |

Vishal |

414 |

300 |

15.27% |

17.00% |

-1.73% |

|

3 |

Preet |

273 |

97 |

10.07% |

5.50% |

4.57% |

|

4 |

Malkit |

235 |

116 |

8.67% |

6.57% |

2.09% |

|

5 |

John Deere |

173 |

73 |

6.38% |

4.14% |

2.24% |

|

6 |

Dasmesh |

136 |

67 |

5.01% |

3.80% |

1.22% |

|

7 |

Guru Nanak |

72 |

46 |

2.65% |

2.61% |

0.05% |

|

8 |

New Holland |

59 |

88 |

2.18% |

4.99% |

-2.81% |

|

9 |

K.S. Agricultural |

57 |

27 |

2.10% |

1.53% |

0.57% |

|

10 |

Mahindra |

54 |

24 |

1.99% |

1.36% |

0.63% |

|

11 |

Punni Vishavkarma |

44 |

27 |

1.62% |

1.53% |

0.09% |

|

12 |

Panesar Agro |

35 |

10 |

1.29% |

0.57% |

0.72% |

|

13 |

Shaktiman |

33 |

38 |

1.22% |

2.15% |

-0.94% |

|

14 |

Surindera |

33 |

35 |

1.22% |

1.98% |

-0.77% |

|

15 |

Hira Agro |

28 |

15 |

1.03% |

0.85% |

0.18% |

|

|

Other Brands |

561 |

499 |

20.69% |

28.27% |

-7.59% |

|

|

Total |

2,712 |

1,765 |

100.00% |

100.00% |

TRACTORGYAN |

Compared to last year, the total harvester sales from April 2025 to May 2025 totalled 2,712 units. This data shows a good response to the market and increasing mechanization in Indian farming.

Selling 505 units, Kartar Harvesters became the YTD leader, reflecting a rise of 66.67% from last year. Vishal sold 414 units and ranked second in the market. Though its market share fell by 1.73%, the brand continues to be a regular performer in certain states.

While Preet and Malkit closely followed with 273 and 235 units sold, respectively, Preet occupied the 3rd position with a 10.07% market share, while Malkit had an increased market share of 2.09% from April 2024 to May 2024. John Deere attained the 5th spot with YTD sales of 173 units and a market share of 6.38%.

State-wise Harvester Sales in May 2025

Uttar Pradesh was leading the harvester market with 22.35% market share in the April-May 2025 period and registered sales of 606 units in May 2025. Malkit and Kartar were the top choices for UP farmers.

The second-largest contributor, Punjab, reported sales of 577 units,

followed by Madhya Pradesh, which sold 294 harvesters during the same time. In Punjab, Kartar and Vishal stayed as the market leaders, with sales of 182 and 99 units, respectively.

Haryana was placed fourth with 251 harvester sales;

Maharashtra remained close at the 5th position with 238 units sold.

Conclusion

With companies like Kartar, Vishal, and Preet guiding the charge, May 2025 has strengthened the development narrative of the Indian harvester sector. Demand for mechanized farming keeps rising; hence, brand competition should become fiercer in the next months.

Why Should One Trust Tractor Gyan?

Tractor Gyan is India's most reliable platform for agricultural machinery insights. From real-time sales updates to in-depth comparisons, our system guides farmers and agri-businesses in making decisions.

We provide verified sales figures, expert brand comparisons, state-wise market trends, and tractor & harvester price support. For the most recent developments in the changing field of farming machinery, keep in touch with Tractor Gyan – Your Reliable Agri-Tech Companion.

Category

Write Your Comment About Retail Harvester Market Registered 51.55% Growth in May 2025, Sold 1,364 Harvesters

.webp&w=1920&q=75)

Top searching blogs about Tractors and Agriculture

07 Jan 2026

18 Dec 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

09 Feb 2026

31 Jul 2025

18 Dec 2025

26 Dec 2025

.webp&w=2048&q=75)

.webp&w=2048&q=75)

.webp&w=2048&q=75)