Retail harvester sales in January 2026: Sold 1,994 harvesters, rise 42.33%

India’s retail harvester market delivered a strong performance in January 2026, with total sales reaching 1,994 units, compared to 1,401 units in January 2025, registering a year-on-year growth of around 42.33%. This sharp increase reflects rising mechanisation demand and improved buying sentiment across key agricultural regions. Let’s discuss the retail harvester sales performance in detail, covering brand-wise and year-to-date trends to understand how the market has evolved.

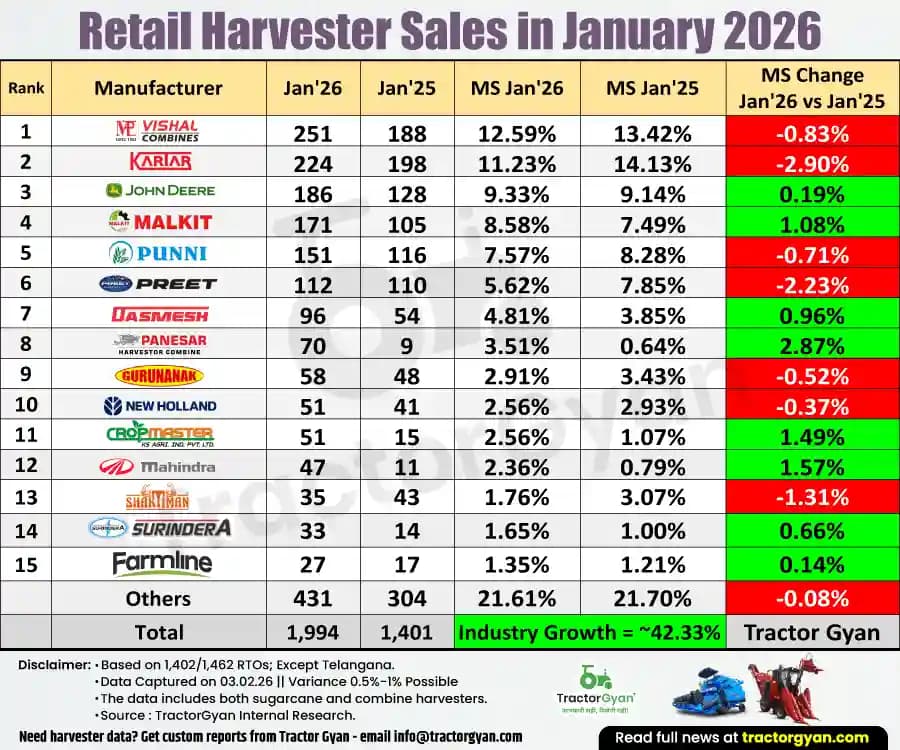

Retail Harvesters Sales in January 2026

- Vishal sold 251 units in January 2026, while it sold 188 units in January 2025. Its market share declined from 13.42% to 12.59%, showing a market share decline of 0.83%, despite higher volumes.

- Kartar reported sales of 224 units in January 2026, compared to 198 units in January 2025. However, its market share dropped from 14.13% to 11.23%.

- John Deere sold 186 units in January 2026 versus 128 units in January 2025. Its market share increased slightly from 9.14% to 9.33%, registering a positive change of 0.19%.

- Malkit recorded 171 units in January 2026, up from 105 units last year. Its market share improved from 7.49% to 8.58%, showing a growth of 1.08% YoY.

- Punni Vishavkarma sold 151 units in January 2026 compared to 116 units in January 2025. However, its market share declined from 8.28% to 7.57%, a drop of 0.71%.

The top 5 brands together sold 983 units, contributing around 49.3% of total harvester sales in January 2026.

Retail Harvesters Sales YTD (April 2025 to January 2026)

- Vishal sold 2,195 units during Apr’25–Jan’26, compared to 1,254 units last year. Its market share increased from 13.53% to 15.13%, showing a 1.60% increase in market share.

- Kartar recorded 1,852 units this year versus 1,528 units last year. Its market share fell from 16.49% to 12.77%, reflecting a decline of 3.72% YoY.

- John Deere sold 1,190 units in the current YTD period compared to 572 units last year. Its market share improved from 6.17% to 8.20%, registering a positive growth of 2.03%.

- Malkit reported 1,137 units, up from 563 units last year. Its market share increased from 6.08% to 7.84%, showing a growth of 1.76%.

- Preet sold 1,061 units during Apr’25–Jan’26 compared to 536 units last year. Its market share rose from 5.78% to 7.31%, reflecting a growth of 1.53% YoY.

The top 5 brands together contributed 7,435 units, accounting for around 51.25% of total YTD harvester sales.

| Rank | Manufacturer | Apr'25-Jan'26 | Apr'24-Jan'25 | Market Share Apr'25-Jan'26 |

Market Share Apr'24-Jan'25 |

Market Share Change YTD Jan'26 vs Jan'25 |

|---|---|---|---|---|---|---|

| 1 | Vishal | 2,195 | 1,254 | 15.13% | 13.53% | 1.60% |

| 2 | Kartar | 1,852 | 1,528 | 12.77% | 16.49% | -3.72% |

| 3 | John Deere | 1,190 | 572 | 8.20% | 6.17% | 2.03% |

| 4 | Malkit | 1,137 | 563 | 7.84% | 6.08% | 1.76% |

| 5 | Preet | 1,061 | 536 | 7.31% | 5.78% | 1.53% |

| 6 | Dasmesh | 801 | 377 | 5.52% | 4.07% | 1.45% |

| 7 | New Holland | 595 | 415 | 4.10% | 4.48% | -0.38% |

| 8 | Punni Vishavkarma | 526 | 297 | 3.63% | 3.21% | 0.42% |

| 9 | Guru Nanak | 321 | 235 | 2.21% | 2.54% | -0.32% |

| 10 | Shaktiman | 284 | 245 | 1.96% | 2.64% | -0.69% |

| 11 | Mahindra | 288 | 146 | 1.99% | 1.58% | 0.41% |

| 12 | K.S. Agricultural | 284 | 140 | 1.96% | 1.51% | 0.45% |

| 13 | Panesar | 276 | 60 | 1.90% | 0.65% | 1.26% |

| 14 | Surindera | 224 | 156 | 1.54% | 1.68% | -0.14% |

| 15 | Hira Agro | 166 | 94 | 1.14% | 1.01% | 0.13% |

| Others | 3,307 | 2,648 | 22.80% | 28.58% | -5.78% | |

| Total | 14,507 | 9,266 | Industry Growth = ~56.56% | Tractor Gyan | ||

Statewise – Retail Harvesters Sales from April 2025 to January 2026

Rank 1 - Uttar Pradesh: Retail Harvester Sales from April 2025 to January 2026

Uttar Pradesh emerged as the largest market with 2,873 units, contributing 19.80% of total sales. The state maintained its leadership position due to a large cultivated land area and increasing mechanisation adoption.

Rank 2 - Punjab: Retail Harvester Sales from April 2025 to January 2026

Punjab followed closely with 2,427 units, accounting for 16.73% of total sales. Strong wheat and paddy harvesting demand continued to support steady harvester sales in the state.

Rank 3 - Madhya Pradesh: Retail Harvester Sales from April 2025 to January 2026

Madhya Pradesh recorded sales of 1,978 units, contributing 13.63% to the national total. Growing acreage under wheat and soybeans helped the state remain among the top contributors.

Rank 4 - Maharashtra: Retail Harvester Sales from April 2025 to January 2026

Maharashtra reported 1,888 units during the period, forming 13.01% of overall sales. Rising custom hiring activity supported sales growth in the state.

Rank 5 - Haryana: Retail Harvester Sales from April 2025 to January 2026

Haryana completed the top five with 1,336 units, contributing 9.21% of total retail harvester sales. Continued focus on mechanised harvesting kept demand stable in the region.

The top 5 states together accounted for 10,502 units, which is around 72.38% of total retail harvester sales out of the overall 14,507 units sold during April 2025 to January 2026.

Conclusion

The Indian retail harvester market has delivered a strong performance in both January 2026 and the YTD period, backed by rising mechanisation, better farm economics, and growing awareness among farmers. While overall volumes have grown sharply, market share shifts indicate increasing competition.

Tractor Gyan – India's Most Impactful Agri-Tech Voice

India’s most impactful Agri-tech voice, with a thriving community of over 1 million farmers across social media platforms. In the last calendar year alone, we achieved an impressive 56 crore impressions across the internet. Trusted by leading brands like Massey Ferguson, Sonalika, Eicher, Mahindra Finance, Farmtrac and many more.

कैटेगरी

और ब्लॉग पढ़ें

1st February 2026, Mumbai: January 2026 marked a strong start for Mahindra & Mahindra’s Farm Equipment Business, including its Swaraj Tractors range. The company reported total tractor sales of 40,643 units in January 2026, reflecting healthy demand across markets. Let’s discuss...

The Indian tractor industry started 2026 on a strong note, reflecting healthy demand across key agricultural states. In January 2026, total retail tractor sales are 1,12,737 units, compared to 91,979 units in January 2025, registering a solid year-on-year growth of 22.57%. This...

Sonalika Tractors has marked a strong beginning to its 30th anniversary year by clocking its fastest-ever overall tractor sales of 1.51 lakh units in just 10 months (April 2025 to January 2026). This performance includes both domestic and export volumes and reflects...

इसके बारे में अपनी टिप्पणी लिखें Retail harvester sales in January 2026: Sold 1,994 harvesters, rise 42.33%

.webp&w=1920&q=75)

ट्रैक्टर और कृषि से जुड़े सबसे अधिक खोजे जाने वाले ब्लॉग्स

07 Jan 2026

18 Dec 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

09 Feb 2026

31 Jul 2025

18 Dec 2025

26 Dec 2025

.webp&w=2048&q=75)

.webp&w=2048&q=75)

.webp&w=2048&q=75)