Harvester Retail Sales Achieved 43.66% Growth in February 2025: Find Harvester Brands’ YOY, YTD, and State-Wise Performance

Rising demand for new agricultural technologies is pushing the Indian harvester market to grow quickly in 2025. This article shares the retail harvester sales data for February 2025, highlighting the top harvester-selling brands, sales by state, and year-to-date (YTD) figures.

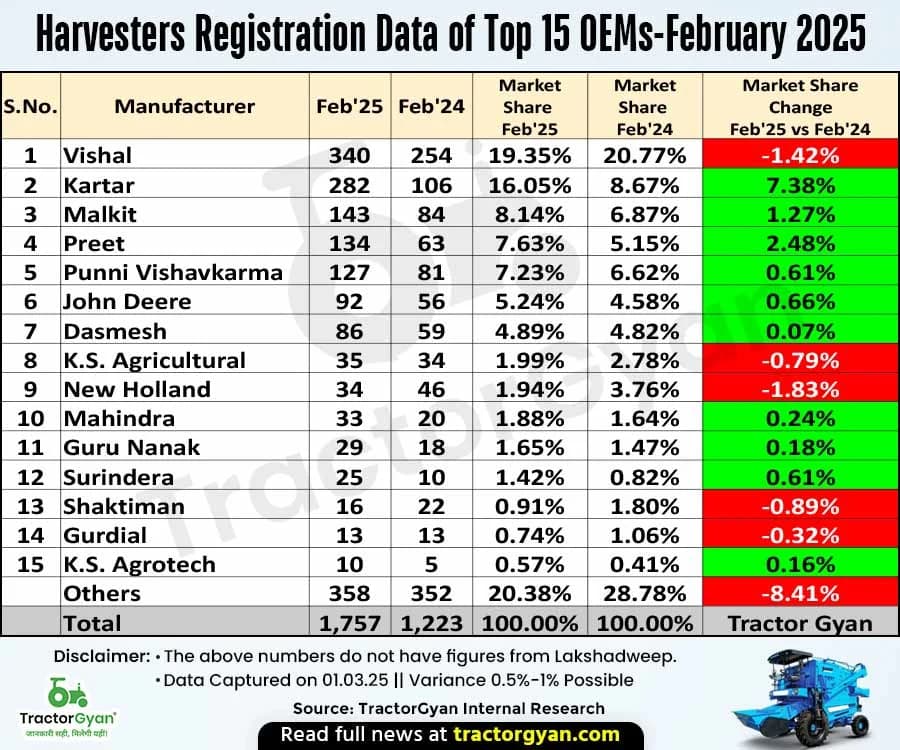

February 2025 vs February 2024: Brands with a Competitive Edge

The harvester market grew 43.66% in February 2025 compared to February 2024. In February 2025, Vishal sold 340 harvesters and acquired the topmost position in the market, but its market share declined by 1.42% from February 2024. With a 16.05% market share, Kartar Harvesters occupied the second position with sales of 282 harvesters.

Malkit Harvesters kept growing, selling 143 units in February 2025 and securing the third position with a market share of 8.14%. Preet got fourth place by selling 71 harvesters more in February 2025 than the 63 harvesters sold in February 2024. Punni Vishavkarma placed fifth with 7.23% of the market share of harvester sales in February 2025.

Year-to-Date (April 2024 - February 2025 vs. April 2023 - February 2024) Harvester Sales

|

Harvester Retail Sales FY 2024-25 |

||||||

|

S.No. |

Manufacturer |

Apr'24-Feb'25 |

Apr'23-Feb'24 |

Market Share |

Market Share |

MS Change |

|

1 |

Kartar |

1,810 |

1,241 |

16.43% |

13.09% |

3.34% |

|

2 |

Vishal |

1,597 |

1,481 |

14.49% |

15.62% |

-1.13% |

|

3 |

Malkit |

706 |

704 |

6.41% |

7.43% |

-1.02% |

|

4 |

Preet |

669 |

517 |

6.07% |

5.45% |

0.62% |

|

5 |

John Deere |

661 |

420 |

6.00% |

4.43% |

1.57% |

|

6 |

Dasmesh |

463 |

302 |

4.20% |

3.19% |

1.02% |

|

7 |

New Holland |

448 |

292 |

4.07% |

3.08% |

0.99% |

|

8 |

Punni Vishavkarma |

424 |

202 |

3.85% |

2.13% |

1.72% |

|

9 |

Gurdial |

271 |

201 |

2.46% |

2.12% |

0.34% |

|

10 |

Guru Nanak |

261 |

266 |

2.37% |

2.81% |

-0.44% |

|

11 |

Shaktiman |

261 |

166 |

2.37% |

1.75% |

0.62% |

|

12 |

Surindera |

181 |

135 |

1.64% |

1.42% |

0.22% |

|

13 |

Mahindra |

177 |

37 |

1.61% |

0.39% |

1.22% |

|

14 |

K.S. Agricultural |

175 |

202 |

1.59% |

2.13% |

-0.54% |

|

15 |

K.S. Agrotech |

167 |

104 |

1.52% |

1.10% |

0.42% |

|

|

Other Brands |

2,747 |

3,210 |

24.93% |

33.86% |

-8.93% |

|

|

Total |

11,018 |

9,480 |

100.00% |

100.00% |

TRACTORGYAN |

The cumulative sales of harvesters from April 2024 to February 2025 reached 11,018 units, showing a strong market performance over the fiscal year. Kartar sold 1,810 harvesters, the highest in the market, in the YTD period, compared to the sales of 1,241 units in the same period last year. It shows a wonderful growth of 3.34% in the overall market share.

Vishal's market share is 14.49% by selling 1,597 harvesters during the period. Malkit sold 706 harvesters with 6.41% Market share, but its overall market share dropped by 1.02%.

Preet saw a 0.62% growth in market share during FY 24-25, with a sale of 669 harvesters. John Deere performed exceptionally well, increasing YTD sales from 420 units (April 2023 to February 2025) to 661 units from April 2024 to February 2025.

State-Wise Harvester Retail Sales from April 2024 to February 2025 Analysis: Regional Market Leaders

With 2,793 units sold during April 2024 to February 2025, Punjab was first among states for harvester sales. Kartar occupied the first position in Punjab by selling 559 units, and Vishal remained in second place with a 13.25% market share.

Madhya Pradesh came in 2nd place, selling 1,627 harvesters. The best sellers in the state were Kartar and Vishal.

Uttar Pradesh followed closely with 1,612 units sold. Malkit (13.65%) and Vishal (12.97%) were the top sellers.

Haryana sold 1,141 harvesters, 10.36% of the country's total sales.

Chhattisgarh was in fifth place and sold 1,023 harvesters, 9.28% of the total sales.

Final Thoughts

Vishal, Kartar and Malkit ranked highest among retail harvester sellers in February 2025 due to their great demand in the Indian market. Indian harvester demand is expected to rise more in 2025.

Category

Read More Blogs

Mahindra & Mahindra Ltd. consistently expands its presence in the agricultural machinery sector. The Mahindra & Mahindra wholesale tractor sales statistics for February 2025 indicated a positive trend in domestic and international markets. Let us examine Mahindra's performance over the past month...

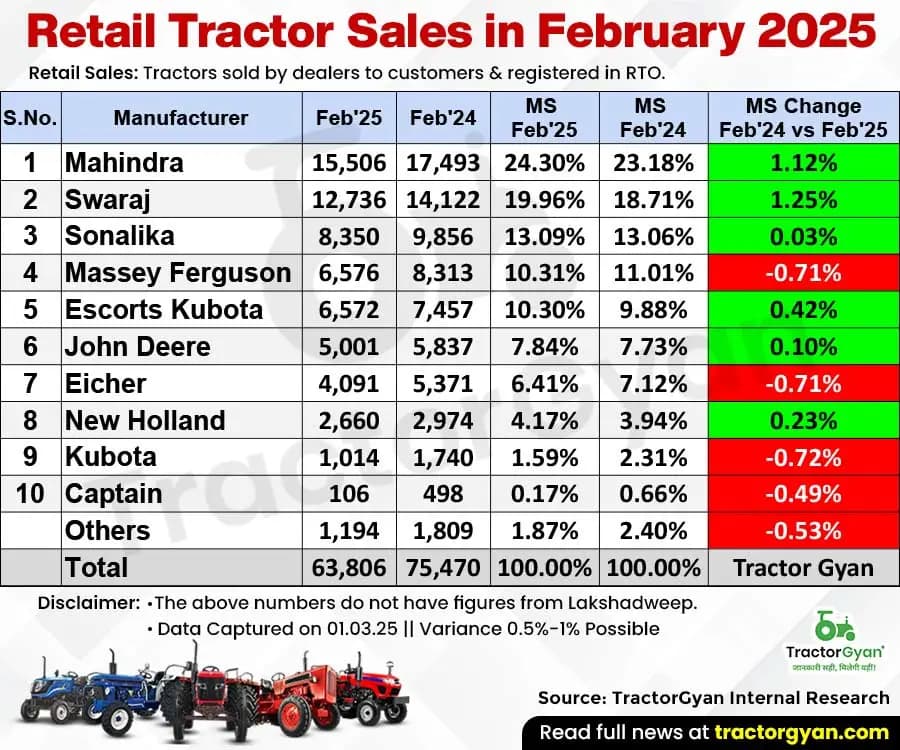

The Indian retail tractor industry declined in February 2025, with sales down 15.46% across the major brands. Let's examine tractor retail sales year over year, year to date, and state-wise.

February 2025 vs. February 2024: Retail Tractor Sales Strong Growth Across Leading Brands

In...

VST Tillers Tractors Limited has transformed the agricultural industry with cutting-edge tractors and tillers. This blog comprehensively analyzes VST's wholesale sales of tractors and power tillers in February 2025.

Wholesale VST Power Tillers Sales in February 2025

VST Tillers Tractors Limited sold 3,773 power...

Write Your Comment About Harvester Retail Sales Achieved 43.66% Growth in February 2025: Find Harvester Brands’ YOY, YTD, and State-Wise Performance

.webp&w=1920&q=75)

Top searching blogs about Tractors and Agriculture

07 Jan 2026

18 Dec 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

09 Feb 2026

31 Jul 2025

18 Dec 2025

26 Dec 2025

.webp&w=2048&q=75)

.webp&w=2048&q=75)

.webp&w=2048&q=75)