Above 50 HP vs Below 50 HP - Retail tractor sales in August 2025

Table of Content

Tractor sales in India are often influenced by HP segments, with farmers choosing models based on their needs. Here’s a quick look at above 50 HP and below 50 HP retail tractor sales in August 2025.

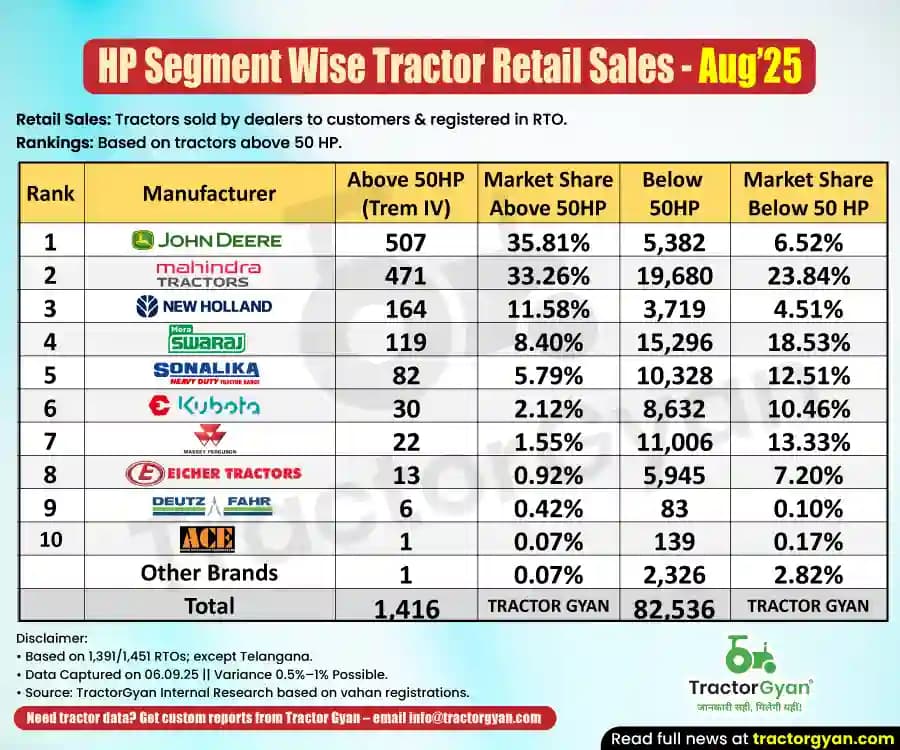

Above 50 HP (Trem IV) - Retail Tractor Sales in August 2025

The Above 50 HP (Trem IV) retail tractor sales in August 2025 are 1,416 units, representing a 1.68% market share. John Deere secured the first position in the Above 50 HP (Trem IV) retail tractor sales by selling 507 units.

Mahindra Tractors followed closely with a market share of 33.26 and 471 tractor sales. New Holland occupied the third place with sales of 164 tractors in August 2025. Overall, the three brands occupy 80.65% of the market in the Above 50 HP (Trem IV) retail tractor sales.

Below 50 HP - Retail Tractor Sales in August 2025

In August 2025, the below 50 HP retail tractor sales are 82,536 units, which is 98.31% of the total retail tractor sales this month. Mahindra secured the first spot in this category with sales of 19,680 units. Swaraj secured an 18.53% market share with sales of 15,296 tractors in the Below 50 segment.

Massey Ferguson occupied the third spot in the Below 50 HP retail tractor sales with 11,006 units and 13.33% market share. Hence, the overall sales of the top three brands totalled 45,982 units, which is 55.71% of the total sales of the Below 50 HP tractors.

Retail Tractor Sales Above 50 HP - YTD (April 2025 to August 2025)

The total retail tractor sales above 50 HP from April 2025 to August 2025 are 7,115 units. John Deere topped the YTD Above 50 HP retail tractor sales by selling 2,568 units during April 2025 to August 2025 with a 36.09% market share.

Mahindra is in second place with sales of 2,328 units and a 32.72% market share. Swaraj sold 707 units in the Above 50 HP retail tractor segment from April 2025 to August 2025, with a market share of 9.94%. These three brands collectively sold 78.75% of the YTD above 50 HP tractors, totalling 5,603 units.

Quick Links

Retail Tractor Sales Below 50 HP - YTD (April 2025 to August 2025)

The total retail tractor sales below 50 HP from April 2025 to August 2025 are 3,71,084 units. From April 2025 to August 2025, Mahindra sold 86,542 tractors in the Below 50 HP segment, with a market share of 23.32%. Swaraj came second with sales of 70,990 units and a 19.13% market share.

Sonalika is third on the list with sales of 50,039 units and a market share of 13.48%. Overall, the combined sales of these top three brands are 2,07,571 units, which is 55.94% of the overall retail tractor sales below 50 HP YTD.

| Rank | Manufacturer | Above 50HP (Trem IV) |

Market Share Above 50HP |

Below 50HP |

Market Share Below 50 HP |

|---|---|---|---|---|---|

| 1 | John Deere | 2,568 | 36.09% | 27,169 | 7.32% |

| 2 | Mahindra | 2,328 | 32.72% | 86,542 | 23.32% |

| 3 | Swaraj | 707 | 9.94% | 70,990 | 19.13% |

| 4 | New Holland | 633 | 8.90% | 16,001 | 4.31% |

| 5 | Sonalika | 475 | 6.68% | 50,039 | 13.48% |

| 6 | Escorts Kubota | 161 | 2.26% | 40,685 | 10.96% |

| 7 | Massey Ferguson | 110 | 1.55% | 44,746 | 12.06% |

| 8 | Eicher | 52 | 0.73% | 24,763 | 6.67% |

| 9 | Same Deutz Fahr | 35 | 0.49% | 260 | 0.07% |

| 10 | Preet | 14 | 0.20% | 692 | 0.19% |

| Other Brands | 32 | 0.45% | 9,197 | 2.48% | |

| Total | 7,115 | TRACTOR GYAN | 3,71,084 |

TRACTOR GYAN |

Conclusion

The Indian tractor market is performing well, as evidenced by the statistics on tractor sales in August 2025. Despite the increasing popularity of tractors with above 50 HP among farmers, the below 50 HP segment remains popular in small-scale agricultural communities.

The tractor sector is preparing for a potential surge in demand over the next few months due to the good monsoon (except few areas where heavy rains are there), new GST reform (from 12% to 5% on tractors), festive season, and the upcoming Trem V norm.

Tractor Gyan – India's Most Trusted AgriTech Platform

India’s most impactful AgriTech voice, with a thriving community of over 1 million farmers across social media platforms. In the last calendar year alone, we achieved an impressive 56 crore impressions across the internet. Trusted by leading brands like Massey Ferguson, Sonalika, Eicher, Mahindra Finance, Farmtrac and many more.

Category

Read More Blogs

01 September 2025, Mumbai: One of India's leading producers of tractors and other agricultural equipment, Mahindra & Mahindra Ltd., has published its August 2025 wholesale tractor sales report. Let's examine the Mahindra and Swaraj Tractor Sales in domestic and export markets in...

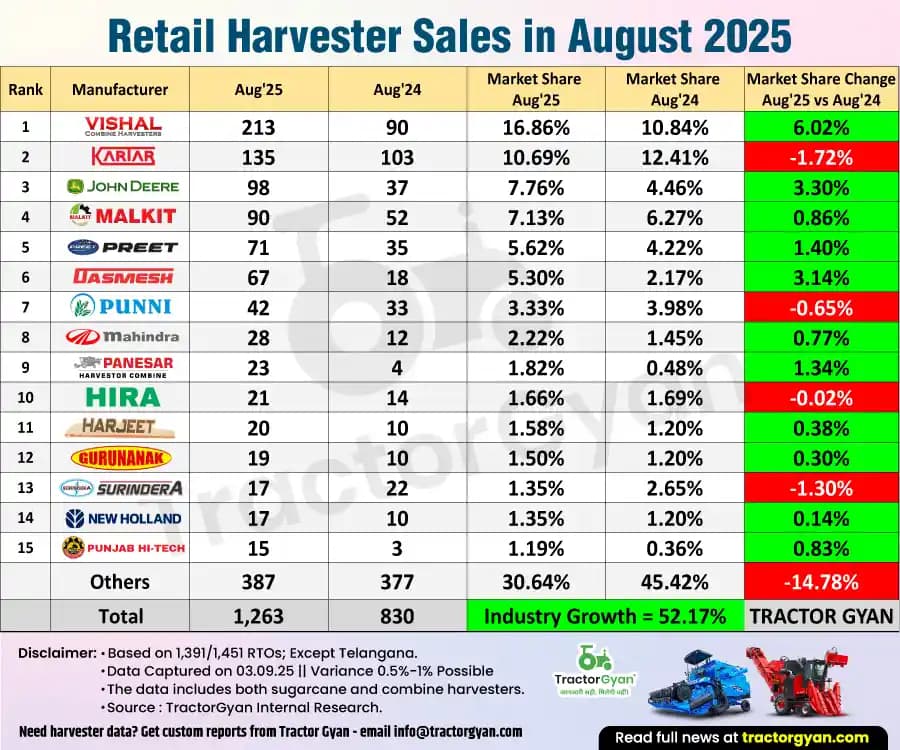

August 2025 is a fantastic month for Indian agriculture, especially for harvesters. Farmers are becoming more and more comfortable with mechanisation. As a result, retail harvesters' sales increased by 52.17% in August 2025.

Retail Harvesters Sales in August 2025

Retail Harvester sales in...

The construction equipment market in India has shown a massive decline of 26.36% in August 2025. Let’s look at the top contenders for the August 2025 construction machinery sales data, brand-wise sales, in this blog.

Construction Equipment Sales in August 2025: Top...

Write Your Comment About Above 50 HP vs Below 50 HP - Retail tractor sales in August 2025

.webp&w=1920&q=75)

Top searching blogs about Tractors and Agriculture

07 Jan 2026

18 Dec 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

09 Feb 2026

31 Jul 2025

18 Dec 2025

26 Dec 2025

.webp&w=2048&q=75)

.webp&w=2048&q=75)

.webp&w=2048&q=75)