Construction Equipment sales in September 2025: Sold 4,457 units, Decline 19.02%

Table of Content

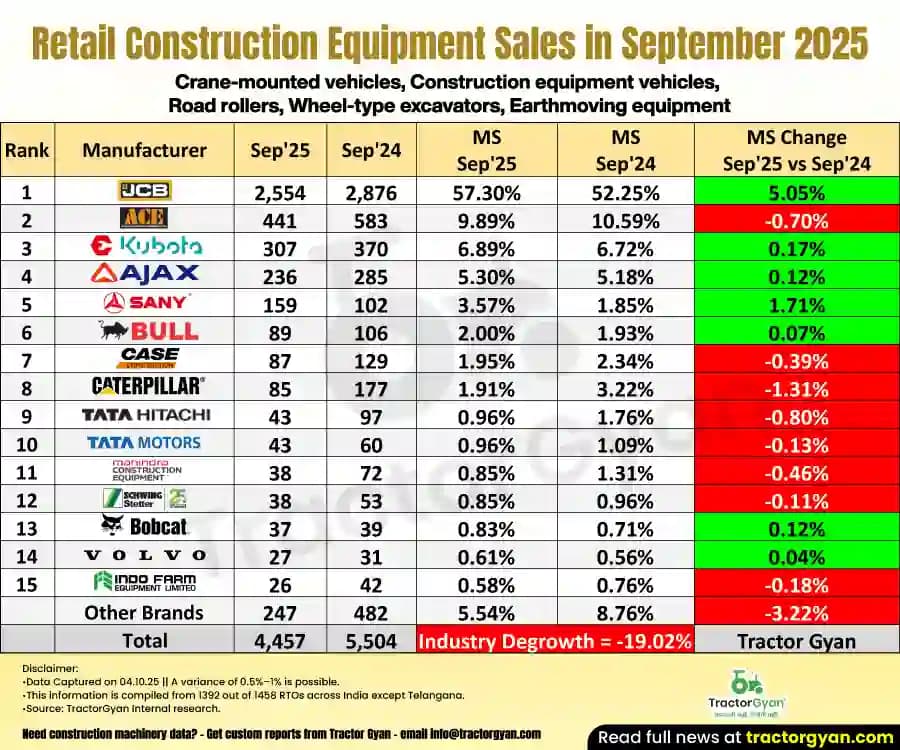

Construction equipment sales are 4,457 units in September 2025, reflecting an overall decline of -19.02%. On a Year-to-Date (YTD) basis, from April to September 2025, the construction machinery industry achieved 32,664 unit sales, but this period also showed a decline of -6.09%.

The outlook for October 2025 looks positive, as festive demand is expected to boost sales. Since Navratri started in the last week of September, many pending registrations from September will likely show up in October 2025 sales, giving the industry a good push.

Construction Equipment Sales in September 2025

- JCB continued its dominance with 2,554 units sold in September 2025. However, this was a decline from 2,876 units in September 2024, translating into a YoY drop of -11.20%. Despite the fall, JCB strengthened its market share to 57.30%, up from 52.25% last year.

- ACE recorded 441 unit sales in September 2025 against 583 units in September 2024, marking a sharp decline of -24.36% YoY. Its market share slightly contracted to 9.89% compared to 10.59% a year earlier.

- Escorts Kubota achieved 307 units in September 2025, down from 370 units last year, reflecting a YoY decline of -17.03%. However, the Escorts Kubota still managed to grow its market share marginally, reaching 6.89% versus 6.72% in September 2024.

- AJAX registered 236 sales in September 2025, compared to 285 units a year earlier, recording a decline of -17.19%. Despite the drop, the company held its ground with a market share of 5.30%.

- SANY (All Terrain Crane) was one of the few bright spots, showing growth in a declining market. It sold 159 units in September 2025, compared to 102 units last year, marking a remarkable growth of +55.88% YoY. This boosted its market share to 3.57%, almost double from last year’s 1.85%.

Construction Machinery Sales YTD (April 2025 to September 2025)

- From April to September 2025, JCB sold 13,837 units, compared to 16,462 units during the same period in 2024. This represents a -15.95% YoY decline. Despite the drop, JCB remains the market leader with 42.36% share, although its share slipped by -4.97% from last year’s 47.33%.

- ACE recorded 3,728 units in YTD 2025, down from 4,271 units in YTD 2024, showing a -12.71% YoY decline. Its market share also decreased slightly to 11.41%, compared to 12.28% last year, indicating a -0.87% drop in share.

- AJAX remained steady with 2,219 units sold in YTD 2025, nearly the same as 2,220 units last year. This represents almost no decline (-0.045%), while its market share improved marginally to 6.79%, up from 6.38%, a +0.41% growth.

- Escorts Kubota reported 2,130 units sold YTD 2025, compared to 2,576 units last year, which is a -17.31% YoY drop. Its market share reduced to 6.52%, compared to 7.41% in YTD 2024, reflecting a -0.89% decline.

- CASE New Holland achieved 1,007 unit sales YTD 2025, up from 769 units in YTD 2024, marking a +30.95% YoY growth. Its market share increased to 3.08%, from 2.21% last year, giving it a +0.87% boost.

| Rank | Manufacturer | Apr'25-Sep'25 (H1) | Apr'24-Sep'24 (H1) | Market Share Apr'25-Sep'25 (H1) |

Market Share Apr'24-Sep'24 (H1) |

Market Share Change YTD (H1) Sep'25 vs Sep'24 |

|---|---|---|---|---|---|---|

| 1 | JCB | 13,837 | 16,462 | 42.36% | 47.33% | -4.97% |

| 2 | ACE | 3,728 | 4,271 | 11.41% | 12.28% | -0.87% |

| 3 | Ajax | 2,219 | 2,220 | 6.79% | 6.38% | 0.41% |

| 4 | Escorts Kubota | 2,130 | 2,576 | 6.52% | 7.41% | -0.89% |

| 5 | Case New Holland | 1,007 | 769 | 3.08% | 2.21% | 0.87% |

| 6 | Caterpillar | 843 | 1,028 | 2.58% | 2.96% | -0.37% |

| 7 | Bull Machines | 777 | 546 | 2.38% | 1.57% | 0.81% |

| 8 | All Terrain Crane | 761 | 519 | 2.33% | 1.49% | 0.84% |

| 9 | Liugong | 758 | 417 | 2.32% | 1.20% | 1.12% |

| 10 | Tata Hitachi | 733 | 536 | 2.24% | 1.54% | 0.70% |

| 11 | Mahindra | 669 | 551 | 2.05% | 1.58% | 0.46% |

| 12 | M/S Schwing Stetter | 634 | 515 | 1.94% | 1.48% | 0.46% |

| 13 | Indo Farm | 533 | 391 | 1.63% | 1.12% | 0.51% |

| 14 | Doosan Bobcat | 352 | 292 | 1.08% | 0.84% | 0.24% |

| 15 | Tata Motors | 318 | 330 | 0.97% | 0.95% | 0.02% |

| Other Brands | 3,365 | 3,358 | 10.30% | 9.65% | 0.65% | |

| Total | 32,664 | 34,781 | Industry Degrowth= -6.09% | Tractor Gyan | ||

Conclusion

The construction equipment industry in India faced a challenging September 2025, with an overall 19.02% YoY decline in sales. While leaders like JCB and ACE saw drops in volumes, they continued to hold significant market positions. Interestingly, SANY and CASE emerged as growth drivers, showing remarkable YoY improvements.

On a YTD basis (April–September 2025), the industry reported an overall -6.09% degrowth, but selective brands managed to buck the trend.

Tractor Gyan – India's Most Impactful Agri-Tech Voice

India’s most impactful Agri-tech voice, with a thriving community of over 1 million farmers across social media platforms. In the last calendar year alone, we achieved an impressive 56 crore impressions across the internet. Trusted by leading brands like Massey Ferguson, Sonalika, Eicher, Mahindra Finance, Farmtrac and many more.

Category

Read More Blogs

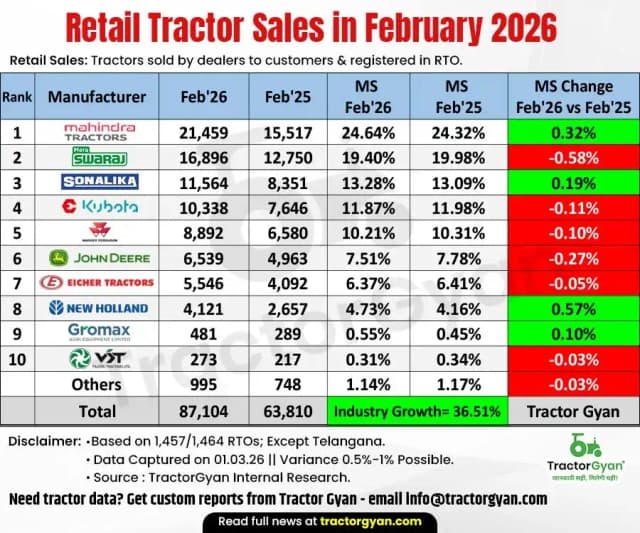

October 01, 2025, Mumbai: Mahindra and Swaraj Tractor sales set a new benchmark in September 2025, achieving domestic sales of 64,946 tractors. This reflects a remarkable growth of 50% compared to the 43,201 tractors sold in September 2024.

Let’s dive into the detailed comparison...

Retail Tractor Sales are 63,093 units in September 2025, with 2.67% growth. The growth in September 2025 appears relatively modest, but this is mainly because the Navratri festival and the new GST reform were implemented during the last week of September...

Retail Harvester Sales are 1,684 units in September 2025, registering a growth of 56.8%. September 2025 has already recorded healthy growth in retail harvester sales, reflecting strong market demand. However, since the Navratri festival and the new GST reform were implemented...

Write Your Comment About Construction Equipment sales in September 2025: Sold 4,457 units, Decline 19.02%

.webp&w=1920&q=75)

Top searching blogs about Tractors and Agriculture

07 Jan 2026

18 Dec 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

09 Feb 2026

31 Jul 2025

18 Dec 2025

26 Dec 2025

.webp&w=2048&q=75)

.webp&w=2048&q=75)

.webp&w=2048&q=75)