Above 50 HP vs Below 50 HP - Retail tractor sales in October 2025

Table of Content

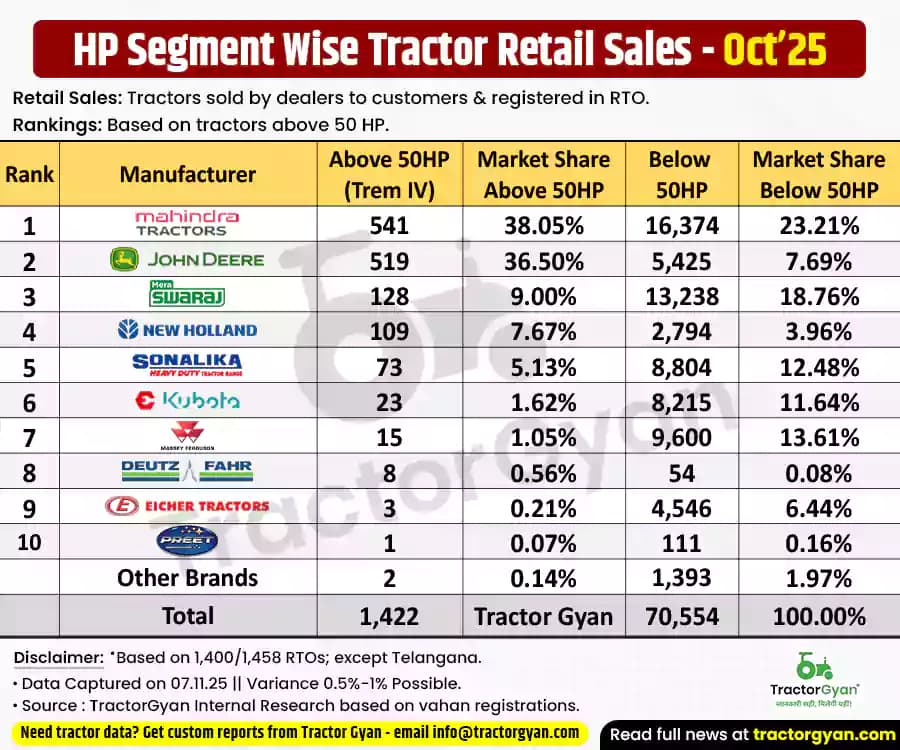

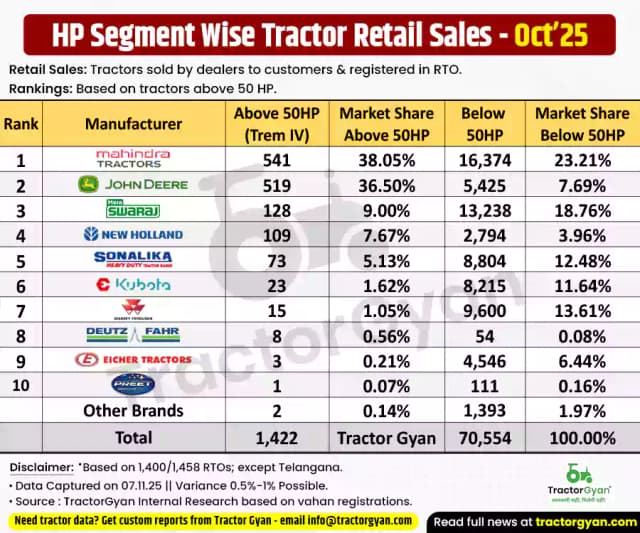

October 2025 highlighted significant trends in India’s tractor industry, showing strong brand performances across both power segments. According to HP-wise tractor sales in October 2025, a total of 1,422 units were sold in the Above 50 HP (Trem IV) category, while the Below 50 HP segment recorded 70,554 units in retail sales. Let’s take a closer look at how the leading brands performed this month and year-to-date.

Above 50 HP (Trem IV) - Retail Tractor Sales in October 2025

In the Above 50 HP category, Mahindra continued to dominate the Indian tractor market with 541 units, capturing 38.05% market share. Close behind, John Deere maintained strong momentum with 519 units, contributing 36.50%.

Swaraj stood third with 128 units and a 9% share, while New Holland ranked fourth with 109 units and 7.67%. Sonalika followed in fifth position, selling 73 units and capturing 5.13% share.

Together, these top five brands sold 1,370 units, contributing an impressive 96.34% of the total 1,422 Above 50 HP tractor sales in October 2025.

Below 50 HP (Trem IV) - Retail Tractor Sales in October 2025

In the Below 50 HP segment, Mahindra once again led the market with 16,374 units, holding 23.21% market share. Swaraj secured second position with 13,238 units and 18.76% share, followed by Massey Ferguson with 9,600 units and 13.61%.

Sonalika took fourth spot with 8,804 units, marking 12.48% share, and Escorts Kubota stood fifth with 8,215 units and 11.64% share.

Combined, these five brands accounted for 56,231 units, contributing nearly 79.7% of the total 70,554 Below 50 HP tractor sales for October 2025.

Quick Links

Retail Tractor Sales Above 50 HP - YTD (April 2025 to October 2025)

From April to October 2025, the Above 50 HP segment continued to see fierce competition between John Deere and Mahindra. John Deere took the lead with 3,053 units, securing 34.66% market share, while Mahindra followed closely with 2,864 units and 32.52%.

Swaraj held third place with 841 units and 9.55%, New Holland ranked fourth with 702 units and 7.97%, and Sonalika came fifth with 555 units, representing 6.30% share.

Overall, these top five manufacturers sold a combined 8,015 units, contributing around 91% of the total 8,808 Above 50 HP tractor sales during the April–October 2025 period.

Retail Tractor Sales Below 50 HP - YTD (April 2025 to October 2025)

In the Below 50 HP segment, Mahindra emerged as the clear market leader during April–October 2025 with 1,18,439 units, capturing 23.48% share. Swaraj followed in second position with 95,787 units and 18.99%, while Sonalika secured third place with 66,587 units and 13.20% share.

Massey Ferguson came next with 62,270 units and 12.34%, whereas Escorts Kubota completed the top five with 59,820 units, representing 11.86% share.

Collectively, these five leading brands sold 4,02,903 units, contributing 79.87% of the total 5,04,460 Below 50 HP retail tractor sales for the April–October 2025 period.

| Rank | Manufacturer | Above 50HP (Trem IV) |

Market Share Above 50HP |

Below 50HP |

Market Share Below 50HP |

|---|---|---|---|---|---|

| 1 | John Deere | 3,053 | 34.66% | 37,261 | 7.39% |

| 2 | Mahindra | 2,864 | 32.52% | 1,18,439 | 23.48% |

| 3 | Swaraj | 841 | 9.55% | 95,787 | 18.99% |

| 4 | New Holland | 702 | 7.97% | 21,935 | 4.35% |

| 5 | Sonalika | 555 | 6.30% | 66,587 | 13.20% |

| 6 | Escorts Kubota | 186 | 2.11% | 59,820 | 11.86% |

| 7 | Massey Fergsuosn | 140 | 1.59% | 62,270 | 12.34% |

| 8 | Same Deutz Fahr | 75 | 0.85% | 346 | 0.07% |

| 9 | Eicher | 52 | 0.59% | 33,170 | 6.58% |

| 10 | Preet | 41 | 0.47% | 888 | 0.18% |

| Other Brands | 299 | 3.39% | 7,957 | 1.58% | |

| Total | 8,808 | Tractor Gyan | 5,04,460 | Tractor Gyan |

Conclusion

Together, these top-performing brands command nearly 80% of India’s tractor market, proving their consistent reliability, advanced technology, and strong connection with Indian farmers. As we move toward the year-end season, the tractor industry looks stable with a promising growth trajectory ahead.

Tractor Gyan - India's Most Impactful Agri-Tech Voice

Tractor Gyan is India’s most impactful Agri-tech voice, with a thriving community of over 1 million farmers across social media platforms. In the last calendar year alone, we achieved an impressive 56 crore impressions across the internet. Trusted by leading brands like Mahindra, Swaraj, Massey Ferguson, Sonalika, Escorts Kubota, New Holland, Eicher, TVS Credit, Garuda Drones and many more.

Category

Read More Blogs

India’s tractor industry continued its steady momentum in October 2025, recording total retail tractor sales of 71,976 units, marking a healthy growth of 13.68% compared to 63,314 units in October 2024. This steady rise highlights the growing confidence of farmers and the...

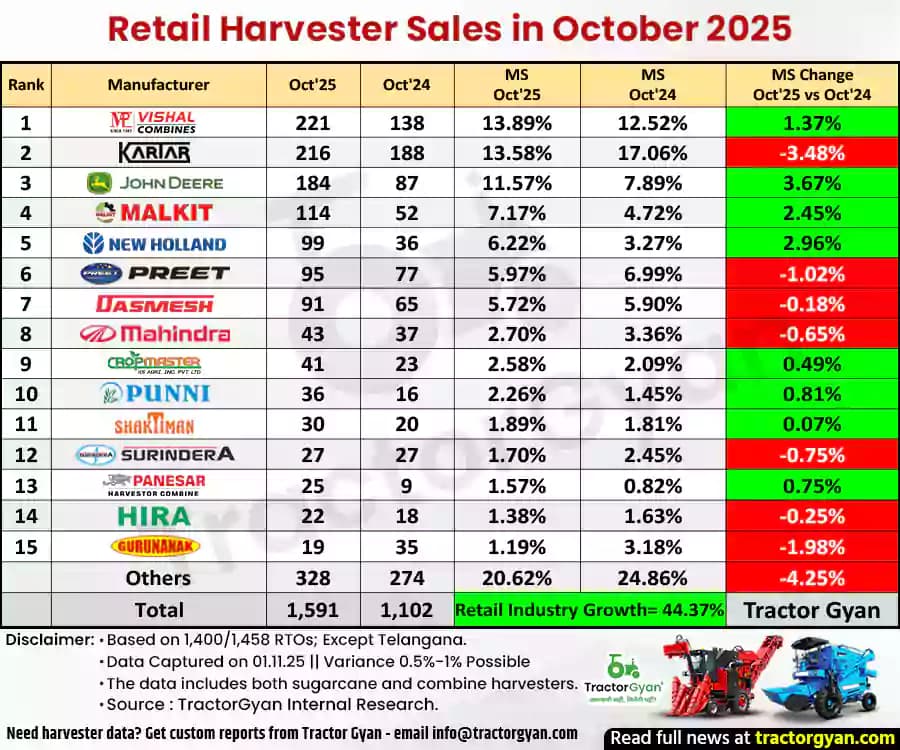

India’s harvester industry witnessed a remarkable jump in October 2025, with retail harvester sales of 1,591 units, compared to 1,102 units in October 2024.

This shows a 44.37% year-on-year growth, reflecting rising mechanisation in farming and increasing demand during the harvesting season.

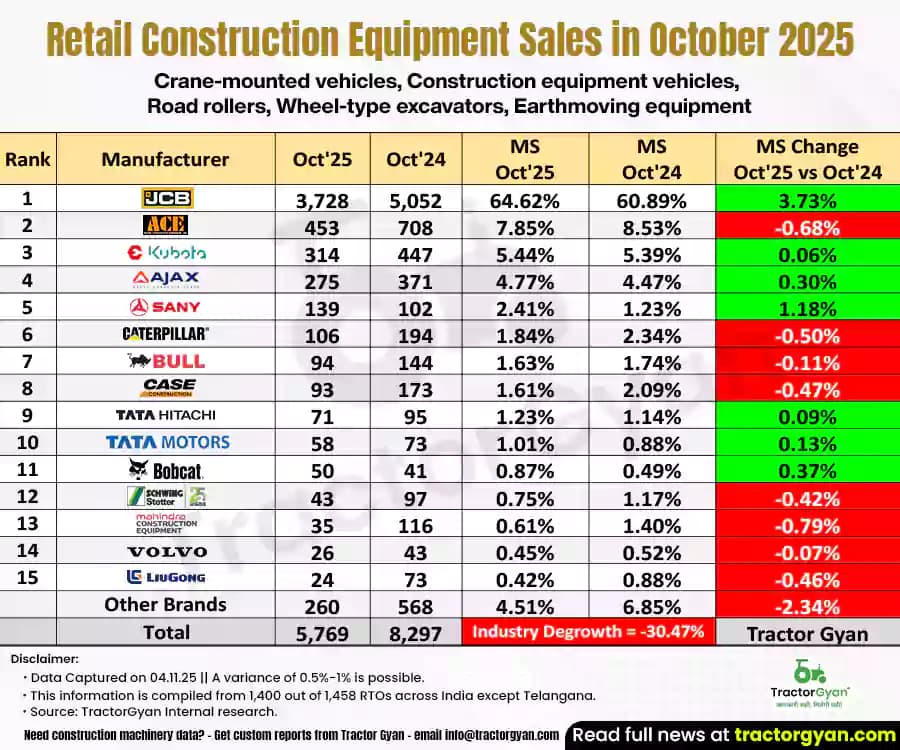

India’s construction equipment industry experienced a slowdown in October 2025, as total retail sales fell to 5,769 units, down from 8,296 units in October 2024, a 30.47% year-on-year (YoY) decline. Let’s take a closer look at how the sector performed in October 2025,...

Write Your Comment About Above 50 HP vs Below 50 HP - Retail tractor sales in October 2025

.webp&w=1920&q=75)

Top searching blogs about Tractors and Agriculture

30 Jul 2025

30 Jul 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

29 Sep 2025

31 Jul 2025

30 Jul 2025

31 Jul 2025

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)