Above 50 HP vs Below 50 HP - Retail Tractor Sales in November 2025

Table of Content

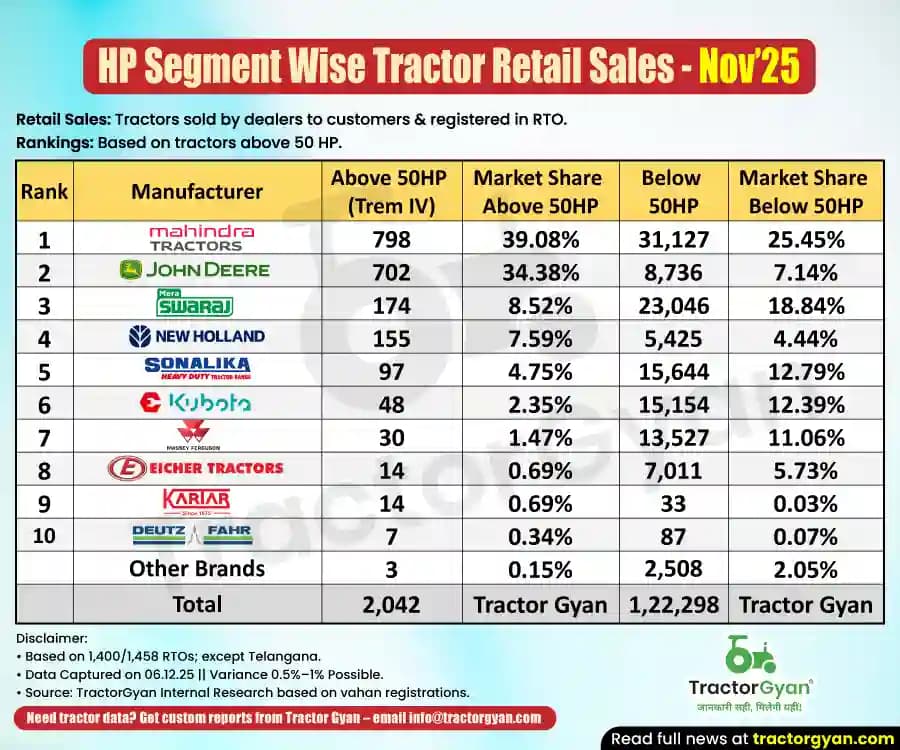

India’s tractor market continued to show a dynamic performance in November 2025, driven by strong demand across both above 50 HP (Trem IV) and below 50 HP segments. The month recorded a total of 2,042 units in the Above 50 HP category and 1,22,298 units in the Below 50 HP segment, reflecting the ongoing preference for high-horsepower as well as compact utility tractors across different farming regions.

Let’s now discuss November 2025 Above and Below 50 HP retail performance and the YTD sales (April-November 2025) in detail.

Above 50 HP (Trem IV) - Retail Tractor Sales in November 2025

In October 2025, the Above 50 HP segment recorded 2,042 units. The Top 5 brands dominated the category with the following performance:

- Mahindra led the Above 50 HP segment with 798 units, securing a dominant 39.08% market share.

- John Deere followed closely, selling 702 units and capturing 34.38%, reflecting strong competition with Mahindra.

- Swaraj claimed the third spot with 174 units, contributing 8.52% to the segment.

- New Holland recorded 155 units, accounting for 7.59% of the total sales.

- Sonalika completed the top five with 97 units, contributing 4.75% to the category.

In conclusion, these top five brands together achieved 1,926 units out of the total 2,042 units sold, contributing an impressive 94.32% to the overall above 50 HP market. The dominance of Mahindra and John Deere is evident, as both brands collectively captured more than 73.46% of this above 50 HP segment.

Below 50 HP (Trem IV) - Retail Tractor Sales in November 2025

The Below 50 HP category recorded 1,22,298 units, with the Top 5 brands performing as follows:

- Mahindra led the Below 50 HP segment with 31,127 units, securing a strong 25.45% market share in this high-volume category.

- Swaraj followed with 23,046 units, contributing 18.84%, reflecting its steady popularity among small and medium farmers.

- Sonalika contributed 15,644 units, securing a solid 12.79% share in the segment.

- Escorts Kubota achieved 15,154 units, capturing 12.39%, showing stable demand despite being positioned at a premium.

- Massey Ferguson recorded 13,527 units, holding 11.06% market share of the total Below 50 HP sales.

Together, these top five brands sold 98,498 units, contributing 80.54% of the total Below 50 HP sales. The segment continues to be volume-driven, with Mahindra and Swaraj jointly accounting for more than 44.30% of the entire market, reinforcing their dominance in India's compact tractor space.

Quick Links

Retail Tractor Sales Above 50 HP - YTD (April 2025 to November 2025)

During the YTD period, the Above 50 HP segment registered 11,843 units, with the leading performers being:

- John Deere led the Above 50 HP YTD segment with 4,233 units, capturing a strong 35.74% share, driven by high demand for its advanced high-HP tractors.

- Mahindra followed very closely with 4,119 units, securing 34.78%, reflecting consistent nationwide performance.

- Swaraj contributed 1,119 units, achieving a 9.45% market share in the segment.

- New Holland added 1,016 units, accounting for 8.58% of the total YTD market share.

- Sonalika completed the top five with 725 units, contributing 6.12% to the segment’s overall performance.

These top five brands collectively sold 11,212 units, commanding an overwhelming 94.67% of the YTD Above 50 HP market. The fierce competition between John Deere and Mahindra remains the highlight of this category, as both brands hold more than 70.52% of the total share, indicating strong farmer preference for powerful and technology-driven tractors.

Retail Tractor Sales Below 50 HP - YTD (April 2025 to November 2025)

The Below 50 HP segment accumulated 6,25,765 units YTD, with the following top 5 contributors:

- Mahindra led the Below 50 HP YTD segment with 1,49,134 units, capturing a strong 23.83% share, backed by its wide product range and deep rural presence.

- Swaraj maintained powerful momentum with 1,18,739 units, securing 18.98%, reaffirming its trust and popularity among small farmers.

- Sonalika delivered 82,158 units, achieving a healthy 13.13% market share within the below 50HP tractor category.

- Massey Ferguson recorded 75,807 units, contributing 12.11% to the segment, reflecting stable demand despite premium positioning.

- Escorts Kubota registered 74,953 units, accounting for 11.98% of the total YTD Below 50 HP sales.

Collectively, these top five brands sold 5,00,791 units, contributing 80.30% of the total YTD Below 50 HP tractor sales. The dominance of Mahindra and Swaraj stands out clearly, as they jointly hold more than 42.81% of the entire market, underscoring their deep-rooted presence in India’s below 50 HP segment.

| Rank | Manufacturer | Above 50HP (Trem IV) |

Market Share Above 50HP |

Below 50HP |

Market Share Below 50HP |

|---|---|---|---|---|---|

| 1 | John Deere | 4,233 | 35.74% | 45,476 | 7.27% |

| 2 | Mahindra | 4,119 | 34.78% | 1,49,134 | 23.83% |

| 3 | Swaraj | 1,119 | 9.45% | 1,18,739 | 18.98% |

| 4 | New Holland | 1,016 | 8.58% | 27,209 | 4.35% |

| 5 | Sonalika | 725 | 6.12% | 82,158 | 13.13% |

| 6 | Escorts Kubota | 258 | 2.18% | 74,953 | 11.98% |

| 7 | Massey Ferguson | 165 | 1.39% | 75,807 | 12.11% |

| 8 | Eicher | 75 | 0.63% | 40,175 | 6.42% |

| 9 | Same Deutz Fahr | 62 | 0.52% | 452 | 0.07% |

| 10 | Kartar | 17 | 0.14% | 296 | 0.05% |

| Others Brands | 54 | 0.46% | 11,366 | 1.82% | |

| Total | 11,843 | Tractor Gyan | 6,25,765 | Tractor Gyan |

Conclusion

The tractor industry in 2025 has shown a balanced mix of strong demand across both above 50 HP and below 50 HP tractor categories. As the rural economy continues to grow and mechanisation expands, these brands are expected to strengthen their presence even further.

Tractor Gyan - India's Most Impactful Agri-Tech Voice

Tractor Gyan is India’s most impactful Agri-tech voice, with a thriving community of over 1 million farmers across social media platforms. In the last calendar year alone, we achieved an impressive 56 crore impressions across the internet. Trusted by leading brands like Mahindra, Swaraj, Massey Ferguson, Sonalika, Escorts Kubota, New Holland, Eicher, TVS Credit, Garuda Drones and many more.

Category

Write Your Comment About Above 50 HP vs Below 50 HP - Retail Tractor Sales in November 2025

.webp&w=1920&q=75)

Top searching blogs about Tractors and Agriculture

07 Jan 2026

18 Dec 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

09 Feb 2026

31 Jul 2025

18 Dec 2025

26 Dec 2025

.webp&w=2048&q=75)

.webp&w=2048&q=75)

.webp&w=2048&q=75)