Above 50 HP vs Below 50 HP - Retail tractor sales in December 2025

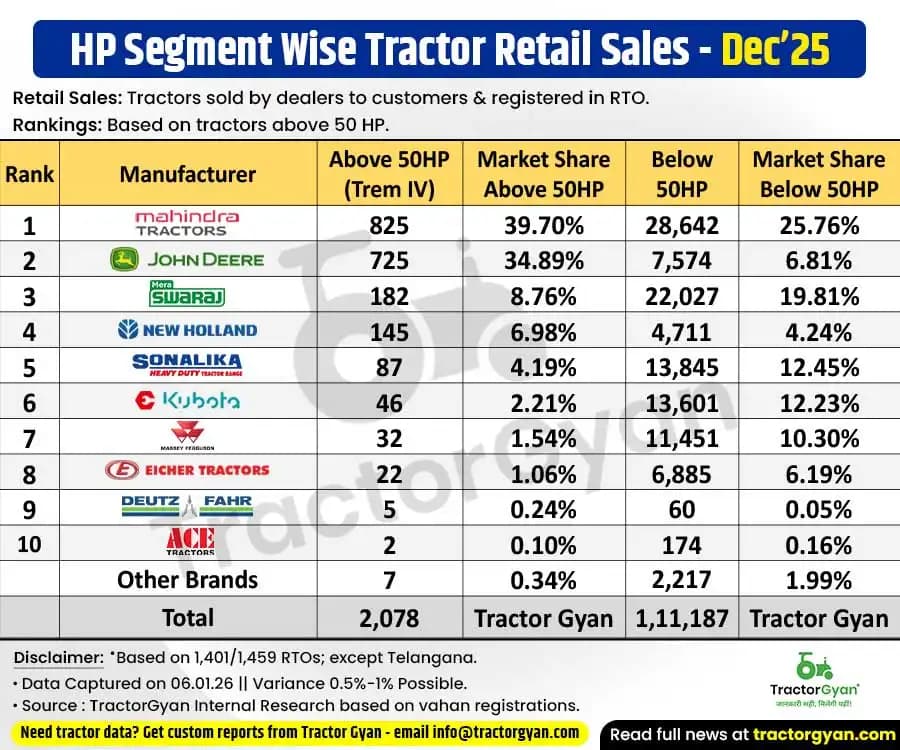

In December 2025, India’s retail tractor sales were 2,078 units in the Above 50 HP (TREM IV) segment, while the Below 50 HP retail tractor sales were 1,11,187 units. The data highlights a steady demand for high-horsepower tractors used in commercial and haulage applications, alongside a strong and sustained preference for lower-horsepower models among farmers for routine agricultural operations.

Above 50 HP (TREM IV) – Retail Tractor Sales in December 2025

- Mahindra Tractors led the Above 50 HP segment in December 2025 with 825 units, holding a 39.70% market share, driven by strong demand.

- John Deere India followed closely, retailing 725 units and capturing a 34.89% share, reflecting continued preference for premium high-performance tractors.

- Swaraj Tractors ranked third with 182 units, and an 8.76% share, supported by the higher-HP tractor models demand.

- New Holland sold 145 units, accounting for a 6.98% market share, backed by steady institutional demand.

- Sonalika Tractors completed the top five with 87 units and a 4.19% share in the Above 50 HP category.

The top 5 tractor brands together sold 1,964 units in December 2025 in the Above 50 HP segment. This accounts for 94.51% of the total 2,078 units sold during the month, indicating that the high-HP market remains highly concentrated among leading manufacturers.

Below 50 HP – Retail Tractor Sales in December 2025

- Mahindra Tractors dominated the Below 50 HP segment with 28,642 units, commanding 25.76% market share, reaffirming its leadership in the mass farming segment.

- Swaraj Tractors ranked second by selling 22,027 units, accounting for 19.81% share, reflecting its strong rural penetration.

- Sonalika Tractors reported 13,845 units, securing 12.45% market share, supported by its affordability-focused product mix.

- Escorts Kubota retailed 13,601 units, contributing 12.23% share, showing competitive strength in the mid-range HP segment.

- Massey Ferguson sold 11,451 units, holding 10.30% market share, driven by consistent replacement demand.

In the Below 50 HP category, the top 5 brands recorded combined sales of 89,566 units in December 2025. This represents 80.55% of the total market volume of 1,11,187 units, highlighting strong dominance by major players despite wider brand participation in this segment.

Retail Tractor Sales Above 50 HP – YTD (April–December 2025)

- Mahindra Tractors led the YTD Above 50 HP segment with 4,946 units, accounting for 35.55% market share, indicating sustained leadership throughout FY2026 so far.

- John Deere India followed closely with 4,945 units, holding 35.54% share, highlighting intense competition at the top.

- Swaraj Tractors retailed 1,302 units, capturing 9.36% market share during the YTD period.

- New Holland recorded 1,162 units, contributing 8.35% share, supported by consistent demand from institutional buyers.

- Sonalika Tractors sold 812 units, securing 5.84% market share in the Above 50 HP YTD category.

On a YTD basis, the top 5 brands sold a total of 13,167 units in the Above 50 HP segment. Their contribution stands at 94.64% of the overall 13,912 units, reflecting consistent leadership and limited fragmentation in the high-horsepower tractor market.

Retail Tractor Sales Below 50 HP – YTD (April–December 2025)

- Mahindra Tractors remained the market leader with 1,77,795 units, contributing 24.13% market share, reinforcing its dominance in the volume-driven segment.

- Swaraj Tractors followed with 1,40,769 units, capturing 19.10% share, backed by strong rural demand.

- Sonalika Tractors sold 96,007 units, holding 13.03% market share, reflecting steady traction.

- Escorts Kubota reported 88,566 units, contributing 12.02% share, supported by balanced product positioning.

- Massey Ferguson retailed 87,262 units, accounting for 11.84% market share in the Below 50 HP YTD segment.

For the Below 50 HP segment, the top 5 manufacturers together accounted for 5,90,399 units during April–December 2025. This equals 80.11% of the total YTD sales of 7,36,961 units, underlining the continued dominance of established brands in the volume-driven tractor market.

| Rank | Manufacturer | Above 50HP (Trem IV) |

Market Share Above 50HP |

Below 50HP |

Market Share Below 50HP |

|---|---|---|---|---|---|

| 1 | Mahindra | 4,946 | 35.55% | 1,77,795 | 24.13% |

| 2 | John Deere | 4,945 | 35.54% | 53,030 | 7.20% |

| 3 | Swaraj | 1,302 | 9.36% | 1,40,769 | 19.10% |

| 4 | New Holland | 1,162 | 8.35% | 31,922 | 4.33% |

| 5 | Sonalika | 812 | 5.84% | 96,007 | 13.03% |

| 6 | Escorts Kubota | 304 | 2.19% | 88,566 | 12.02% |

| 7 | Massey Ferguson | 197 | 1.42% | 87,262 | 11.84% |

| 8 | Eicher | 97 | 0.70% | 47,068 | 6.39% |

| 9 | Same Deutz Fahr | 67 | 0.48% | 512 | 0.07% |

| 10 | Preet | 16 | 0.12% | 1,156 | 0.16% |

| Other Brands | 64 | 0.46% | 12,874 | 1.75% | |

| Total | 13,912 | Tractor Gyan | 7,36,961 | Tractor Gyan |

Conclusion

The December 2025 and YTD tractor retail data clearly show that below 50 HP tractors continue to drive overall industry volumes, while the Above 50 HP segment remains highly competitive, led jointly by Mahindra and John Deere. With the top five brands contributing a significant share of total sales across both segments, the market reflects stable demand and healthy brand competition. Going forward, rural liquidity, crop outlook, and infrastructure activity will remain key factors shaping tractor sales momentum.

Tractor Gyan - India's Most Impactful Agri-Tech Voice

Tractor Gyan is India’s most impactful Agri-tech voice, with a thriving community of over 1 million farmers across social media platforms. In the last calendar year alone, we achieved an impressive 56 crore impressions across the internet. Trusted by leading brands like Mahindra, Swaraj, Massey Ferguson, Sonalika, Escorts Kubota, New Holland, Eicher, TVS Credit, Garuda Drones and many more.

Category

Write Your Comment About Above 50 HP vs Below 50 HP - Retail tractor sales in December 2025

.webp&w=1920&q=75)

Top searching blogs about Tractors and Agriculture

07 Jan 2026

18 Dec 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

09 Feb 2026

31 Jul 2025

18 Dec 2025

26 Dec 2025

.webp&w=2048&q=75)

.webp&w=2048&q=75)

.webp&w=2048&q=75)