Above 50 HP vs below 50 HP - Retail tractor sales in September 2025

Table of Content

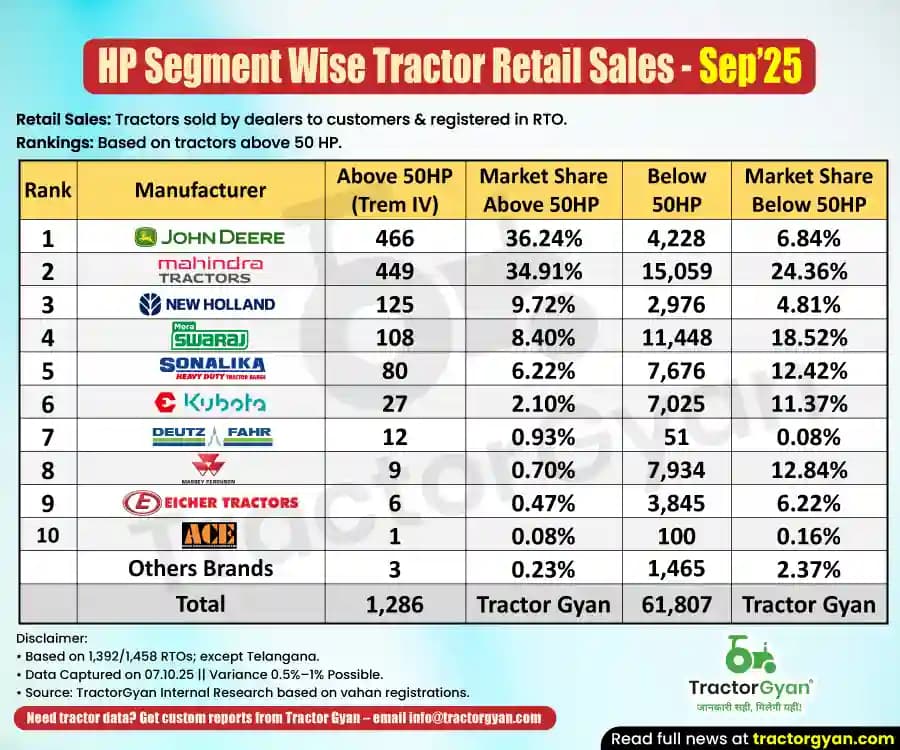

HP Segment Wise Retail tractor sales in September 2025 stood at 1,286 units in the Above 50 HP (Trem IV) segment and 61,807 units in the Below 50 HP segment. The sales in September 2025 appear relatively modest, but this is mainly because the Navratri festival and the new GST reform were implemented during the last week of September 2025. As a result, the registration of some tractors is still pending. These pending registrations are expected to reflect in October 2025 sales, which could show a significant jump compared to September 2025.

For a broader view, we’ve also covered the HP segment-wise tractor retail sales YTD (April 2025 - September 2025) data further below.

Above 50 HP (Trem IV) - Retail Tractor Sales in September 2025

In the Above 50 HP category, a total of 1,286 tractors were sold in September 2025. John Deere retained its leadership position with 466 units, commanding a 36.24% market share, closely followed by Mahindra with 449 units and a 34.91% share.

New Holland secured the third spot with 125 units (9.72%), while Swaraj and Sonalika rounded out the top five with 108 (8.40% market share) and 80 (6.22% market share), respectively.

Together, the top five brands — John Deere, Mahindra, New Holland, Swaraj, and Sonalika — captured 95.49% of the Above 50 HP market in September 2025, showcasing their overwhelming dominance in the high-power tractor category.

Below 50 HP (Trem IV) - Retail Tractor Sales in September 2025

The Below 50 HP segment saw a total of 61,807 tractors sold during September 2025 — indicating this category’s dominance in India’s agricultural landscape.

Mahindra led the market with 15,059 units and a 24.36% market share, followed by Swaraj at 11,448 units (18.52%) and Massey Ferguson at 7,934 units (12.84%). Sonalika with 7,676 units and Escorts Kubota with 7025 units also performed strongly, with 12.42% and 11.37% market share respectively.

The top five brands — Mahindra, Swaraj, Massey Ferguson, Sonalika, and Escorts Kubota — together contribute 79.51% of the Below 50 HP market in September 2025, reaffirming their leadership among small-holding farmers.

Retail Tractor Sales Above 50 HP - YTD (April 2025 to September 2025)

From April to September 2025, total retail sales for the Above 50 HP Trem IV category stood at 8,395 units. Once again, John Deere emerged as the market leader with 3,028 units and a 36.07% share, while Mahindra followed with 2,776 units (33.07%).

Swaraj with 816 units (9.72%) and New Holland with 757 units (9.02%) competed closely for the third and fourth positions. Sonalika with 555 unit sales and 6.61%market share secured fifth position.

The top five players command 94.49% of the Above 50 HP market YTD, proving their consistent grip on India’s premium tractor landscape.

Quick Links

Retail Tractor Sales Below 50 HP - YTD (April 2025 to September 2025)

In the Below 50 HP category, cumulative retail sales from April to September 2025 reached 4,32,897 units. Mahindra once again led with 1,01,603 units (23.47%), maintaining its stronghold in the compact and mid-range tractor space.

Swaraj followed with 82,447 units (19.05%), while Sonalika with 57,703, Massey Ferguson with 52,677, and Escorts Kubota with 50,975 captured 13.33%, 12.17%, and 11.78% shares respectively.

Collectively, the top five brands account for 79.8% of the Below 50 HP market YTD, reflecting their enduring trust and demand among Indian farmers.

| Rank | Manufacturer | Above 50HP (Trem IV) |

Market Share Above 50HP |

Below 50HP |

Market Share Below 50HP |

|---|---|---|---|---|---|

| 1 | John Deere | 3,028 | 36.07% | 31,374 | 7.25% |

| 2 | Mahindra | 2,776 | 33.07% | 1,01,603 | 23.47% |

| 3 | Swaraj | 816 | 9.72% | 82,447 | 19.05% |

| 4 | New Holland | 757 | 9.02% | 18,979 | 4.38% |

| 5 | Sonalika | 555 | 6.61% | 57,703 | 13.33% |

| 6 | Escorts Kubota | 188 | 2.24% | 50,975 | 11.78% |

| 7 | Massey Ferguson | 120 | 1.43% | 52,677 | 12.17% |

| 8 | Eicher | 58 | 0.69% | 28,606 | 6.61% |

| 9 | Same Deutz Fahr | 47 | 0.56% | 312 | 0.07% |

| 10 | Preet | 15 | 0.18% | 801 | 0.19% |

| Others Brands | 35 | 0.42% | 7,420 | 1.71% | |

| Total | 8,395 | Tractor Gyan | 4,32,897 | Tractor Gyan |

Conclusion

The September 2025 tractor retail sales report clearly indicates a dual growth story — steady demand for below 50 HP tractors among small farmers and rising adoption of above 50 HP Trem IV models among commercial users. John Deere and Mahindra remain the front-runners across the above 50 HP segments, and in the below 50 HP segment, Mahindra, Swaraj, and Massey sustain strong momentum.

Tractor Gyan – India's Most Impactful Agri-Tech Voice

India’s most impactful Agri-tech voice, with a thriving community of over 1 million farmers across social media platforms. In the last calendar year alone, we achieved an impressive 56 crore impressions across the internet. Trusted by leading brands like Massey Ferguson, Sonalika, Eicher, Mahindra Finance, Farmtrac and many more.

Category

Read More Blogs

Retail Tractor Sales are 63,093 units in September 2025, with 2.67% growth. The growth in September 2025 appears relatively modest, but this is mainly because the Navratri festival and the new GST reform were implemented during the last week of September...

Retail Harvester Sales are 1,684 units in September 2025, registering a growth of 56.8%. September 2025 has already recorded healthy growth in retail harvester sales, reflecting strong market demand. However, since the Navratri festival and the new GST reform were implemented...

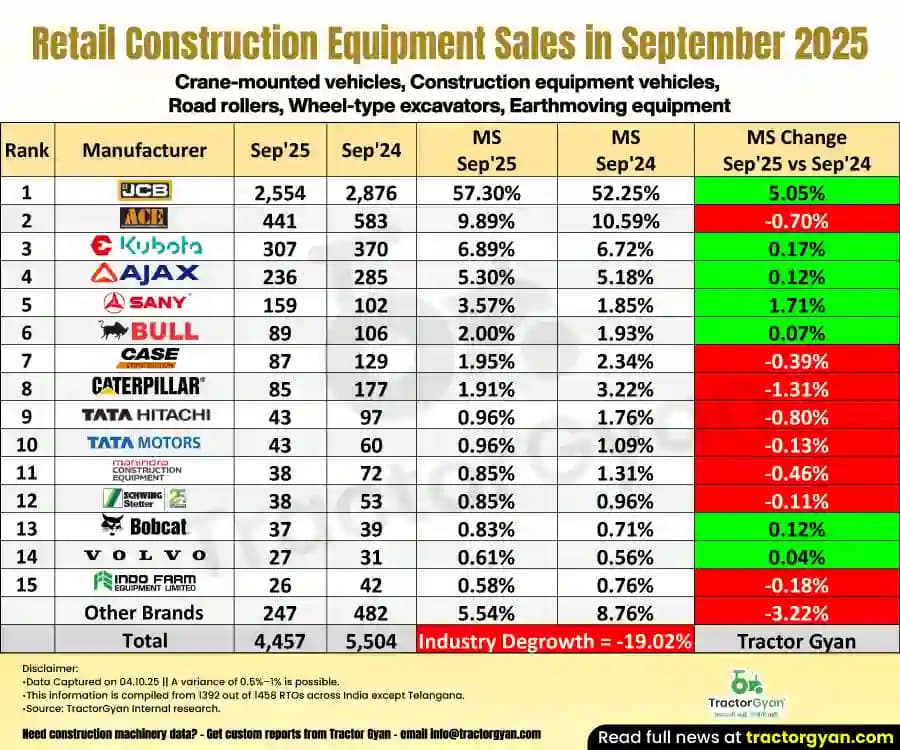

Construction equipment sales are 4,457 units in September 2025, reflecting an overall decline of -19.02%. On a Year-to-Date (YTD) basis, from April to September 2025, the construction machinery industry achieved 32,664 unit sales, but this period also showed a decline of -6.09%.

Write Your Comment About Above 50 HP vs below 50 HP - Retail tractor sales in September 2025

.webp&w=1920&q=75)

Top searching blogs about Tractors and Agriculture

07 Jan 2026

18 Dec 2025

29 Jul 2025

08 Sep 2025

03 Jul 2025

30 Jul 2025

30 Jul 2025

30 Jul 2025

29 Jul 2025

30 Jul 2025

09 Feb 2026

31 Jul 2025

18 Dec 2025

26 Dec 2025

.webp&w=2048&q=75)

.webp&w=2048&q=75)

.webp&w=2048&q=75)